At times like the present, one question inevitably rises to the very top of the heap…

…what do I do next?

Sadly, millions of investors will never know.

For them, the markets are like a one-way street to financial hell. Lacking any sort of cohesive plan, they lurch from one “investment” to another, only to doom themselves to sub-par returns.

Fortunately, you won’t be among them.

Never Start With What You Want to Make

Believe it or not, professional traders don’t wake up in the morning and think about how much money they’re going to make like everybody thinks. Instead, they roll out of bed wondering what could cause them to lose money and how they’re going to avoid it.

Why?

Because they know – like we do – risk is where you start. How much money you make is a function of what you don’t lose in the first place.

Never forget something we’ve talked about many times – the markets have an upward bias.

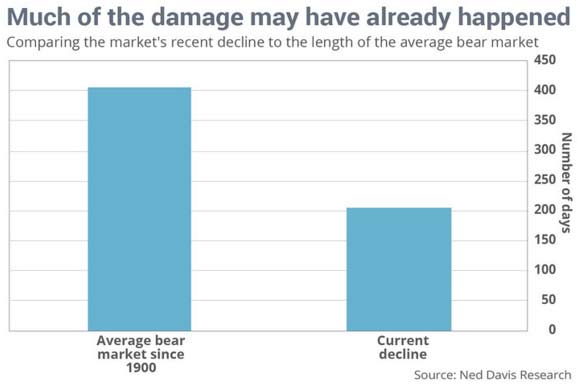

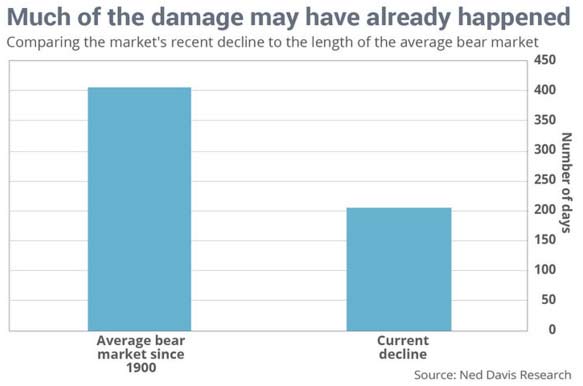

In fact, the current decline is already longer than half the length of the average bear market since 1900. That means that much of the damage everyone fears could get worse may already be in the history books according to Ned Davis Research data as reported by MarketWatch.

I don’t disagree. Stock market corrections tend to end a whole lot quicker and more dramatically than most people expect.

Click to View

That means the most appropriate question today is not should I sell, which is what most people think. But, rather, how do I handle what happens in the meantime?

By putting risk management first – above all other considerations.

Do so and the returns will come – even on days like today when the markets are getting carried out feet first.

Right now that means doing the things we talk about all the time:

Leave A Comment