More Fed Changes Over The Weekend

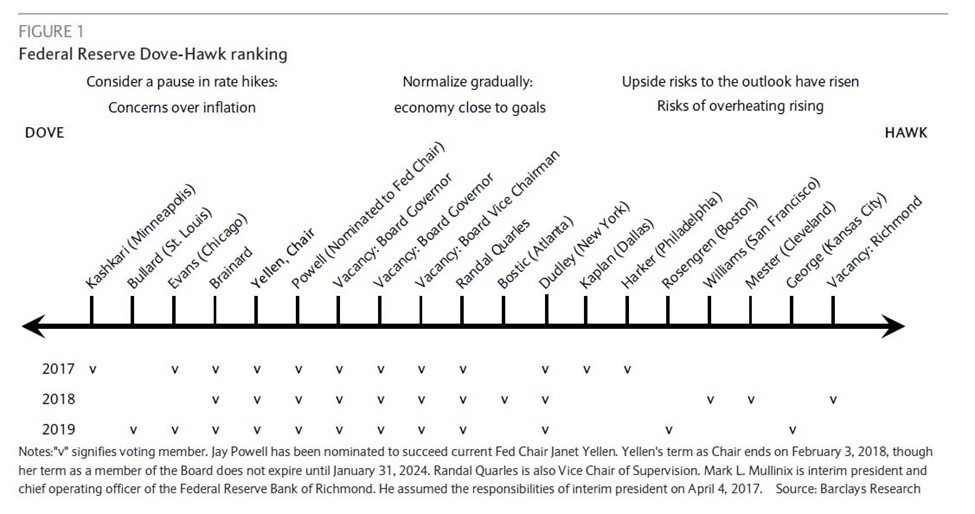

Over the weekend Bill Dudley announced his resignation increasing the turnover at the Fed which was already about to be large with all the empty positions from previous resignations. The Fed officials recognize that President Trump is cleaning house which appears to be why they are resigning. There isn’t a clear direction the Fed is headed in because if the President puts Warsh or Taylor in one of the vacancies, he has added a dove in Powell, a moderate in Quarles, and a hawk in Warsh/Taylor. There are fresh faces, but the monetary policy shouldn’t change much. The one area which will change is regulation as all of President Trump’s picks want to eliminate the unnecessary/burdensome ones.

An analogy would be trimming the excess fat that was created during the post-recession era where regulations were added to prevent the next crisis. We won’t know the context of which the Fed was overhauled in because we don’t know what the economy will do in 2018. If 2018 is a lot like 2017, we probably won’t notice the changes. The Fed is currently on autopilot. However, added inflation or volatility in markets can provoke action which will test the new Fed. I can’t add any more commentary than that until we see who the vice chair will be. That choice will be made in the next few weeks.

Records And No Volatility

Monday was a typical day on Wall Street as the 3 major indexes barely moved and all hit records. The VIX went up 2.84% but stayed below 10 showing how calm the market is. The chart below is evidence of how unusually amazing this market has been. As you can see, there have been 63 new all-time highs in the Nasdaq this year, marking a new record. It’s quite something to see the Nasdaq hit more records than any year in the late 1990s when the tech bubble was in its heyday. The Dow is in the same situation as the Dow has hit 57 record highs this year. That’s the third most record highs going all the way back until 1910 (the most is 69). There is a lot of excitement on Wall Street not just because stocks never go down, but also because deal-making is back. Broadcom is attempting to buy Qualcomm for $103 billion. The low volatility makes the situation ripe for deals. There tends to be more deals at the peak of cycles which isn’t a great signal.

Leave A Comment