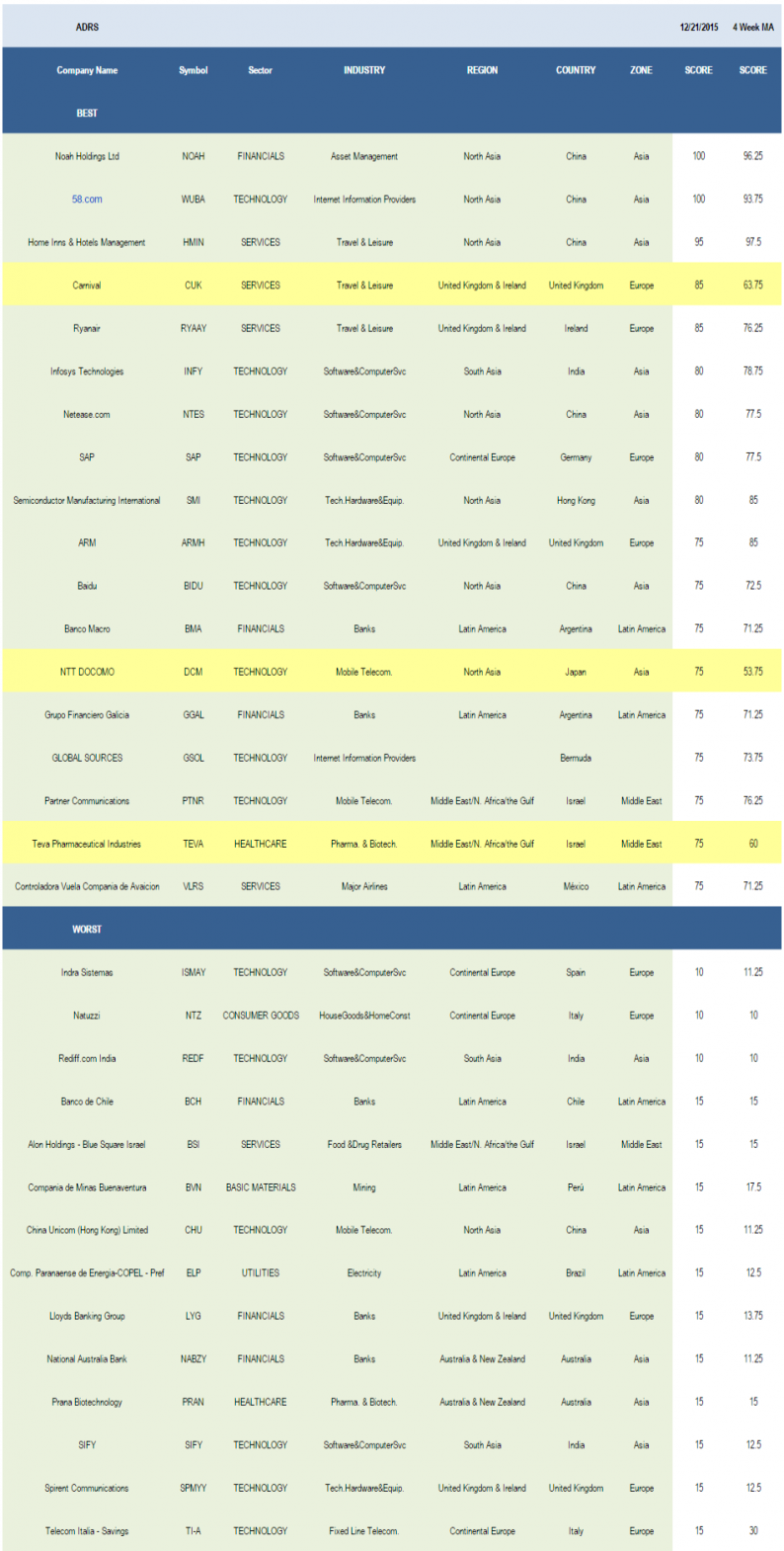

The average score across our universe of 306 ADRs is 44.31 and that’s above both the four and eight week average score of 42.95 and 43.29, respectively. The average ADR is trading -29.67% below its 52 week high, -8.58% below its 200 dma, has 4.48 days to cover held short, and is expected to grow EPS by 10.23% in the coming year.

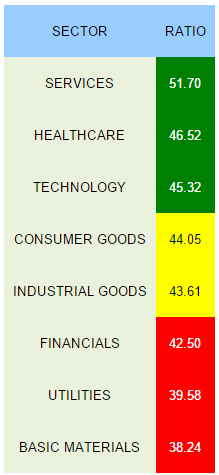

The best sectors to overweight across ADRs are services (HMIN, CUK, RYAAY, VLRS, EDU, AHONY, DEG, KOF, PAC), healthcare (TEVA, SNN, RHHBY, RDY, NVO, EDAP), and technology (WUBA, SMI, NTES, INFY, SAP, DCM, BIDU, ARMH, PTNR, GSOL). Consumer goods and industrial goods score in line with the average ADR universe score. Financials, utilities, and basics score poorly and should be underweight in portfolios until scores improve. Remember, scores will roll to reflect Q1 seasonality in the coming weeks.

The strongest scoring zones are the Middle East (PTNR, TEVA) and North America (RY, BMO). The top regions are MENA, UK/Ireland (CUK, RYAAY, ARMH, NGG, RUK, SNN, PUK), and North America. Bermuda (GSOL, SIG), Taiwan (ASX, TSM, SPIL), Ireland (RYAAY, ICLR), Hong Kong (SMI), and Finland (NOK) are the best countries for money managers to focus on.

Leave A Comment