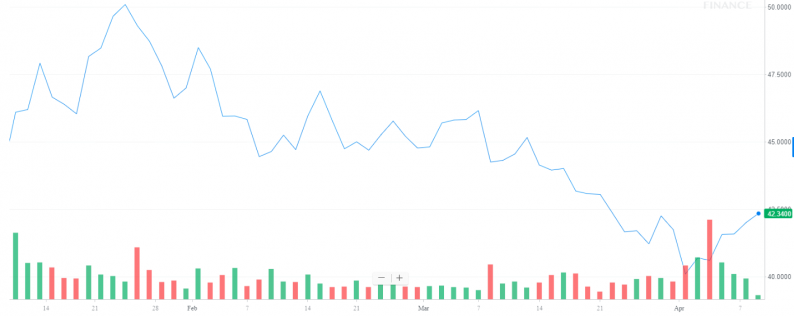

The first time we visited a location, and subsequently hosted a corporate event there, it quickly became clear to us that Dave & Buster’s (PLAY) was a cash cow, and this was without looking into the financials of the company. In this article, we discuss the company’s ability to generate sales and maintain this cash cow status, despite the stock having tanked recently.

Source: Yahoo Finance

As you can see this action is setting up possibly for a BAD BEAT trade, and as such we added it to the BAD BEAT Investing portfolio. Let us discuss what we see in the name here. The first thing we need to ask is how does Dave & Buster’s make its money? Well, it offers entertainment and it offers food and beverages. What we like here is that in genius fashion the company charges more credits for ‘better’ games. After a visit or two, you will quickly realize just how fast these credits could go. We also decided to eat there at our visits and the food was surprisingly high quality compared to what we had expected and was very reasonably priced.

To attract a diverse clientele, there was a full bar complete with over a dozen big screen TVs to offer sporting events and other entertainment. The company is working hard to continue to grow at a manageable pace, but we have had some concerns over the comparable same-store sales. Still, the stock has been hammered. To know whether Dave & Buster’s can still be invested in here, we have to turn to the numbers. And the growth is still there, in many respects.

In the company’s just reported Q4 2017, we saw a few records made. Total sales increased a respectable 14.9%, coming in at $304.9 million, up from $270.2 million in Q4 2016. This seems very strong, however, this top line print may have concerned some on the Street, as Dave and Buster’s missed consensus expectations by $0.6 million. Still, sales continue to propel higher at a reliable pace. The slight miss does not concern us, however, we must be aware of what is influencing the top line.

Leave A Comment