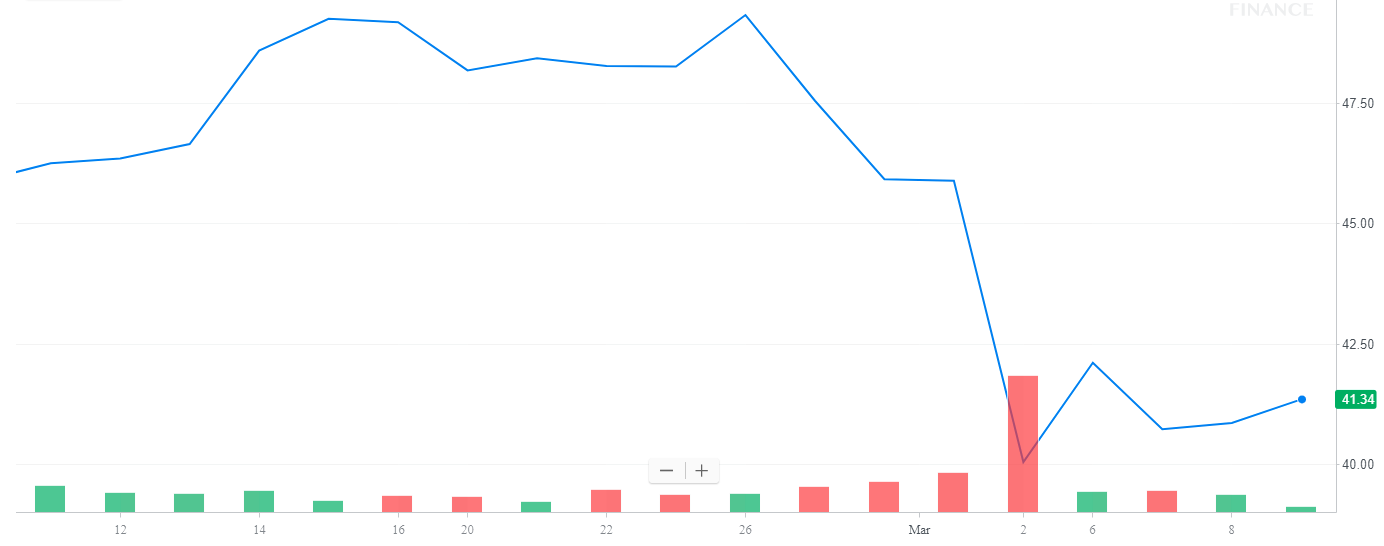

Foot Locker (FL) stock is a buy. It is cheap, it is set to improve significantly in 2018, and it pays a juicy dividend that is yielding over 3.5%. The stock, however, has been slammed recently:

Source: Yahoo finance.

This is a painful drop. But why did this happen? This came from an overreaction to the most recent earnings report. Specifically, big investors hit the panic button when they saw the comparable sales figures. We expect the stock to recover to the $50 level in the next month or so because there is deep value here. But let us talk about these comparable sales which is the focus of the present column.

Keep in mind, we think it is worth noting here that comparable sales are expected to ramp up from their lows seen in Q2 2017 where they fell a devastating 6%.

In the most recent quarter, we were looking for comps to fall -2.5%. That said, it was much worse and this is why investors are dumping the stock right now. This is a key indicator no doubt about it.

Comparable sales had been strong, and very positive up until mid-2017. Comparable sales fell to negative 3.7%. Ouch. We were surprised. Despite a negative 3.7% comparable sales figure in the most recent quarter, we were pleased with the result as comps are still trending upward off the lows from Q2 2017, but there is much work to be done.

Looking ahead to Q1, we expect a continued drag on comparable sales, but this will be in large part due to heavy promotional activity to move merchandise as the company transitions into the latter half of 2018 and beyond.

With that framework in mind, please remember that we previously opined that the second half of the year would see a ramp up in comparable sales, and we stand by that call, but we fully believe the second half of the year is absolutely critical.

We think the back half of 2018 is not only critical to our call, but will be a strong determinant for the future of the company and its stock. There are a number of positives to look for. There are strategic partnerships that have been put into place, an ongoing transition of the company’s management structure, as well as a favorable product cycle.

Leave A Comment