I. Gold’s New Year

Since the New Year, gold is off to a remarkable start. Investors are flooding into gold ETF’s at record pace.

In fact, Blackrock (the elite of the elite on WallSt) had to temporarily suspend issuance of new ETF shares for their gold trust, IAU, because of explosive demand. The statement from Blackrock started with, “Issuance of New IAU (Gold Trust) Shares Temporarily Suspended; Existing Shares to Trade Normally for Retail and Institutional Investors on NYSE Arca and Other Venues. Suspension results from surging demand for gold, which requires registration of new shares.”

As you can see, there have been inflows every single day since 2016:

Blackrock may face penalties over this suspension and unregistered shares. In short, it is a gold trust which means that their shares are backed by gold. As they issue new shares, they need to register them and buy physical gold to back those new shares.

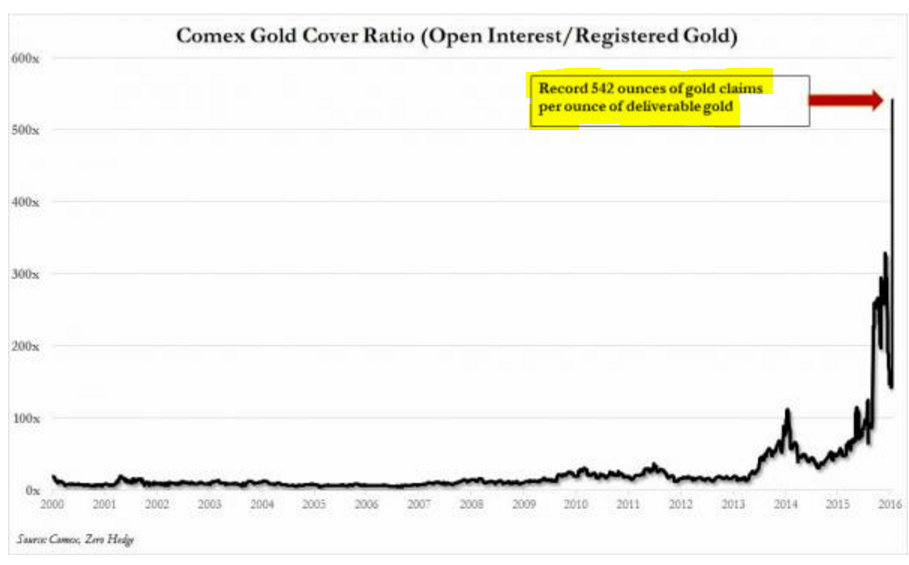

And currently there is a record 542:1 ratio of gold claims-to-physical. This means that there are 542 individuals with claims to 1 physical ounce sitting in the Comex vault.

This warrants the question: could gold ETF’s and Trusts, such as Blackrock’s IAU, even get the physical gold they need delivered? It appears it is going to be first come first serve. As gold demand persists, this will unvravel the fractional-reserve gold market.

Its not really that there is not enough gold, but rather there is not enough gold at today’s prices. Once the price of gold increases significantly, it will attract new supply from sellers taking profits and mining companies with incentive to mine for a profit.

II. The “Ottawa” Bottom?

One who doesn’t study history is ignorant, but one who doesn’t understand the history of gold is a fool. The elites in Canada are both.

Brief history lesson: in 1999 the ingenious British Chancellor, Gordon Brown, thought it was a good idea to sell half of Britain’s gold reserves while gold itself was at a 20-year low. Gold was just under $300/oz. Not only did Britain’s reserves miss out on a violent decade long bull market for gold, reaching $1900/oz by 2011, but the tax payers also suffered (although whoever bought that gold had a very profitable decade and is grateful to Mr. Brown).

Leave A Comment