India’s economy was hit by a major shock in November 2016 when the government of Prime Minister Narendra Modi, without advance notice, withdrew all 500 and 1000 rupee notes from circulation. Those denominations accounted for some 86 percent of all currency in circulation.

The “demonetization,” as it has been called, was intended to undercut the nation’s huge black economy, but, according to critics, it was botched in execution. The short-term result was a sharp drop in GDP growth. However, as Focus Economics reports in its latest Consensus Forecast for East and South Asia, the Indian economy has bounced back and is expected to return to its status as one of the world’s fastest-growing economies.

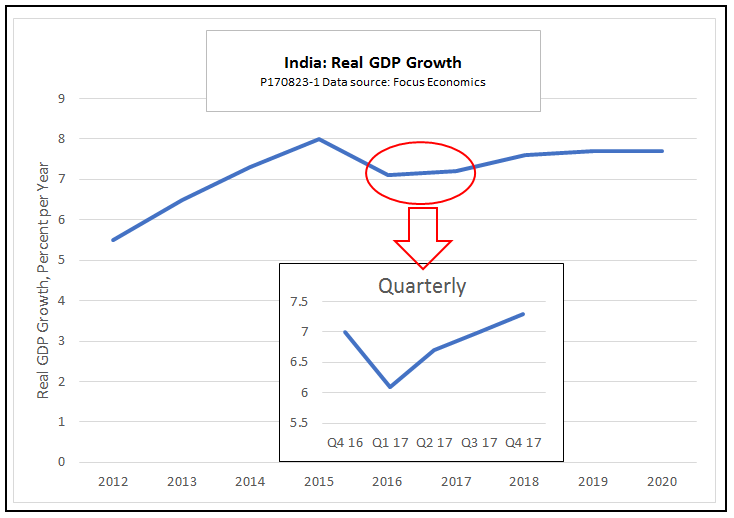

As the chart below shows, growth slowed to just 6.1 percent in the first quarter of 2017 but rose to 6.7 percent in Q2. Focus Economics projects growth of 7.2 percent for the full year of 2017.

Meanwhile, Indian observers are reporting that demonetization has made headway against its main target, the underground economy. An assessment in IndianEconomy.net finds that Modi’s reform, as intended, has improved tax compliance, shrunk the informal economy, and accelerated the adoption of electronic payments. In those regards, it has facilitated another major reform this year, the introduction of a new goods and services tax.

If all goes well, the Indian economy should grow at torrid 7.6 percent pace in 2018. That rate would far outpace China’s expected growth of 6.3 percent, making India the best-performing economy in the region, if not the world.

Leave A Comment