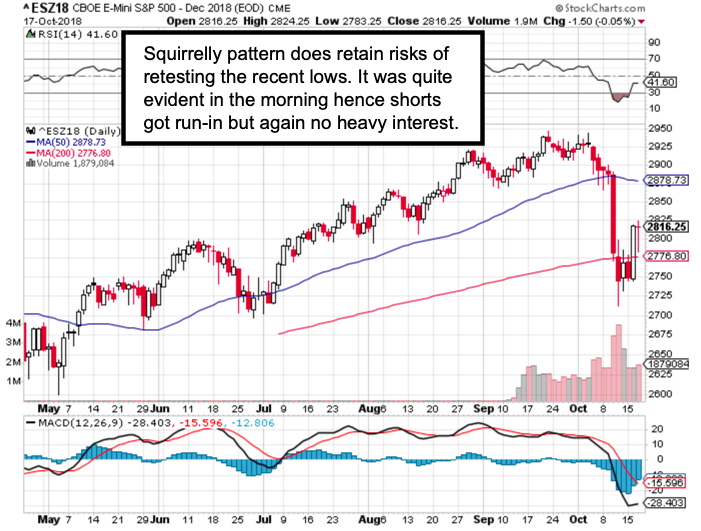

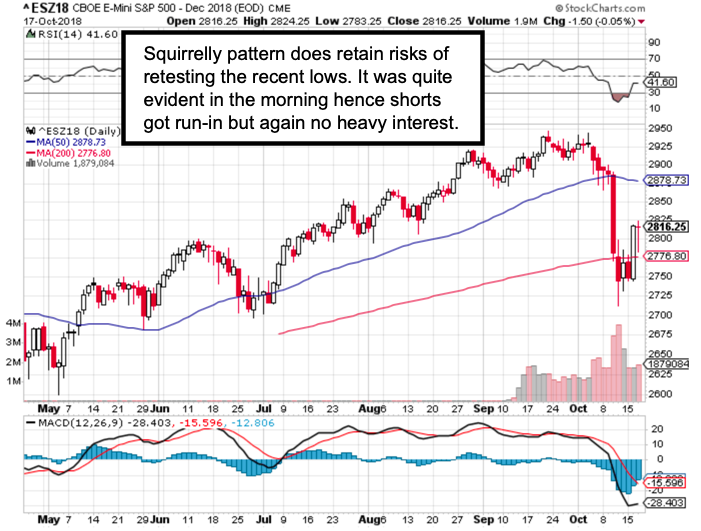

Warning Bulls not to declare victory yesterday, I suggested what we had, on relatively low volume, was primarily an ‘essential’ rebound off of a key 200-Day Moving Average for the S&P, that stocks had flirted with just above and below for a few days.

Now the ‘infighting’ on Wednesday by the S&P swings shows this clearly is not based simply on monetary, earnings, or even trading prospects; but on traders (and hedge managers) desperately trying to hold the pattern in a semblance of ‘order’, lest algorithmic selling triggers get activated on a closing break below that level.

In the interim, of course many got run-in if they shorted weakness. Retreat a couple weeks and you’ll recall (even before a ‘crash alert’ warning right as the DJIA and S&P made record highs) our suggesting (especially for all FANG-type stocks) that investors or traders lighten-up ‘as’ the Averages at the time were climbing not just a ‘worry wall’, but the upper ‘band’ (or trend line if you prefer) trying to grind-out higher highs; but with underlying sales fairly evident, especially in the momentum stocks.

Then and now I believed the Bulls have virtually no chance of hitting stock market balls ‘out of the ballpark’ so to speak; aside special situations as of course always present themselves. But on a broader basis danger retains its pall over this market, regardless of proclamations of value some insist is there. It is in some stocks; it mostly absent for broad Senior Indexes.

Bits & Bytes: notes that the (desperate?) Appeal by the DOJ to overturn the completed AT&T / Time Warner (now Time Media) merger has a date.

During the deliberations, the DOJ had called on AT&T and Time Warner to sell all or part of Turner Broadcasting Group – the group of cable networks that includes CNN – or to sell-off DirecTV and keep the cable networks as a potential requirement for approving the pending deal.

Leave A Comment