The stock market has had a bumpy ride lately and volatility is elevated. That means juicy option premiums for traders willing to bet that the market will rebound within the next few weeks.

On Friday, VIX spike to 25.65, having been as low as 15.34 just a few days earlier.

Traders, who believe the decline is temporary can achieve high returns via a bull put spread on SPY.

One trading opportunity for those traders with a bullish bias is a Bull Put Spread using the $220 strike as the short put and the $225 strike as the long put.

As of March 25th, this trade offered an 11.11% return on risk over the next 80 calendar days when using the June 15th expiry.

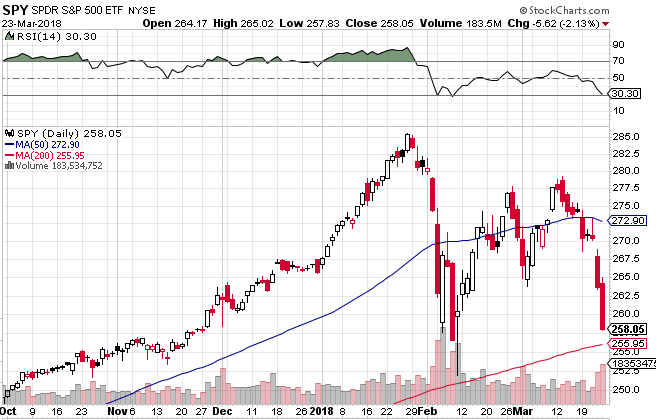

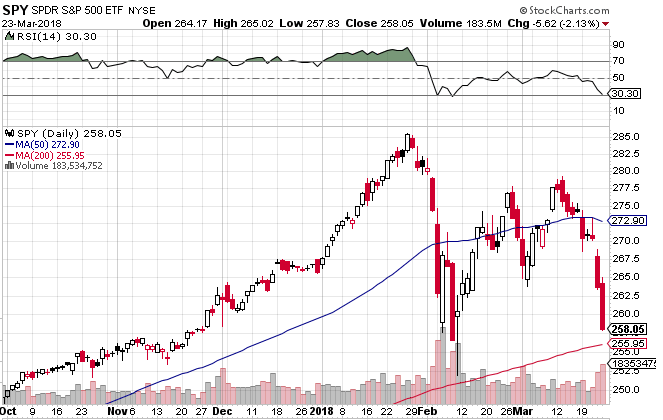

The S&P 500 closed right at the 200-day moving average on Friday at around 2588. Some traders believe this level might provide support for stocks this week.

The maximum profit on the trade would be $50 per contract with a maximum risk of $450. The spread would achieve the maximum 11.11% profit if SPY closes above $230 on June 15th in which case the entire spread would expire worthless allowing the premium seller to keep the $55 option premium.

The maximum loss would occur if SPY closes below $225 on June 15th which would see the premium seller lose $450 on the trade.

The breakeven point for the Bull Put Spread is $229.50 which is calculated as $230 less the $0.50 option premium per contract. Keep in mind that due to the bid-ask spread, you may not be able to get filled at these prices.

Looking at the chart, SPY is holding above the 200 day moving average and RSI is getting into oversold levels. The RSI indicator is at 30.30.

See chart below:

Leave A Comment