Greetings,

Let’s start with the energy markets where fundamentals continue to create headwinds for oil prices.

1. US crude oil inventories reach the highest level since the late 1920s.

2. Inventories at Cushing, OK (the WTI futures settlement hub) rise to record levels.

3. US oil output is barely budging in spite of a number of producers operating at a loss or extremely thin margins.

4. And it’s not just about shale: offshore oil production in the Gulf of Mexico is expected to hit a new record next year.

Source: EIA

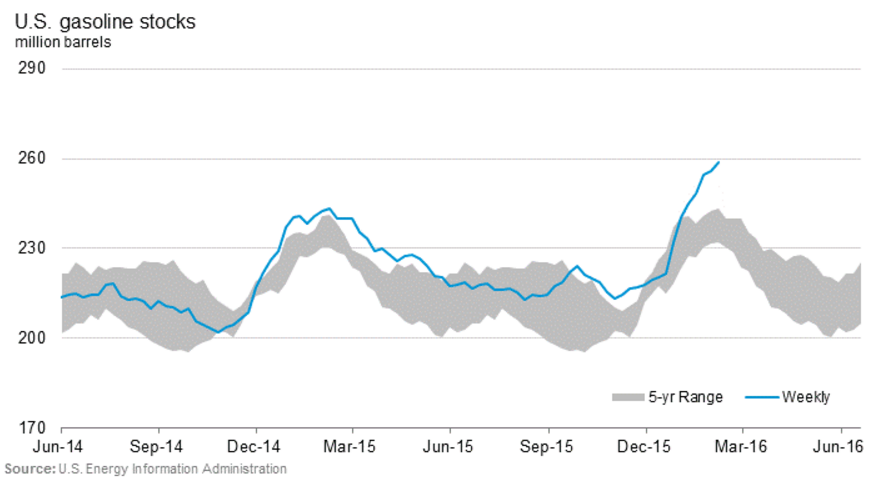

5. Perhaps the most striking aspect of crude oil fundamentals is what’s happening with US refined products. US gasoline inventories hit another record.

Moreover, the demand for distillates (such as diesel and heating oil) is far below last year’s levels.

Also, here is the amount of fuel ethanol now in storage.

There seems to be some price stabilization in a number of other commodities however.

1. Here we have iron ore futures (Singapore) – still a fraction of the highs reached over the past decade but showing signs of life.

Source: barchart

2. Nitrogen fertilizer (urea) futures have spiked sharply after a multi-year decline.

Source: barchart

One commodity that continues to struggle is sugar. The “sugar high” is over, as the bets on El Niño related damage hadn’t worked out too well.

Source: barchart

Turning to emerging markets, the Argentine peso hit a record low (chart shows the number of pesos one dollar can buy).

Source: Investing.com

Argentina reported its first trade deficit in 16 years. Why all of a sudden? It turns out that the figures reported by the previous administration weren’t exactly clean and in the spirit of more transparency the new government revised the results, showing weakening exports. This revision of economic data is a positive development and Mauricio Macri’s government should be applauded.

Leave A Comment