Greetings,

Let’s begin with Friday’s markets where the volatility has finally returned. A confluence of events including the ECB’s inaction, some of the Fed officials’ hawkish comments, Jeffrey Gundlach turning bearish on bonds and technical factors sent markets into a sharp correction. Machine-driven activity accelerated the selloff. The equity markets were particularly spooked by the sharp correction in global bonds.

1. The Treasury curve steepened as longer-dated yields jumped.

2. The situation was even more severe for Europe. French and Italian 30y government bond yields are shown below.

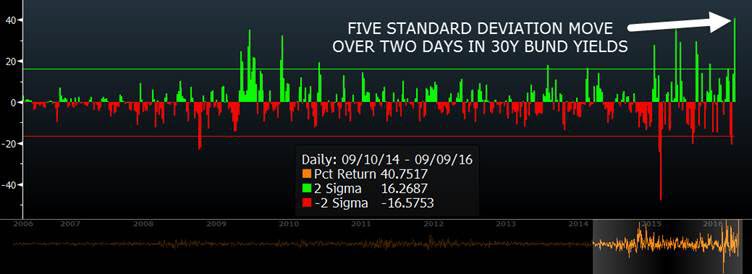

3. Bunds had a rough couple of days following the ECB’s decision to stay pat.

Source: McElligott (RBC)

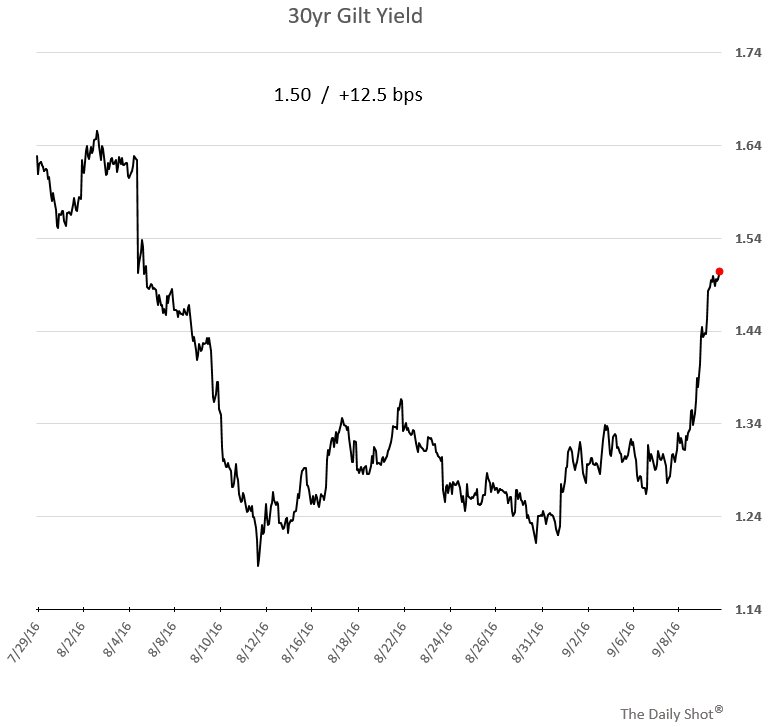

4. Similar to the moves in the Eurozone, the 30yr gilts yield was up 12.5bp (3.6% drop in price).

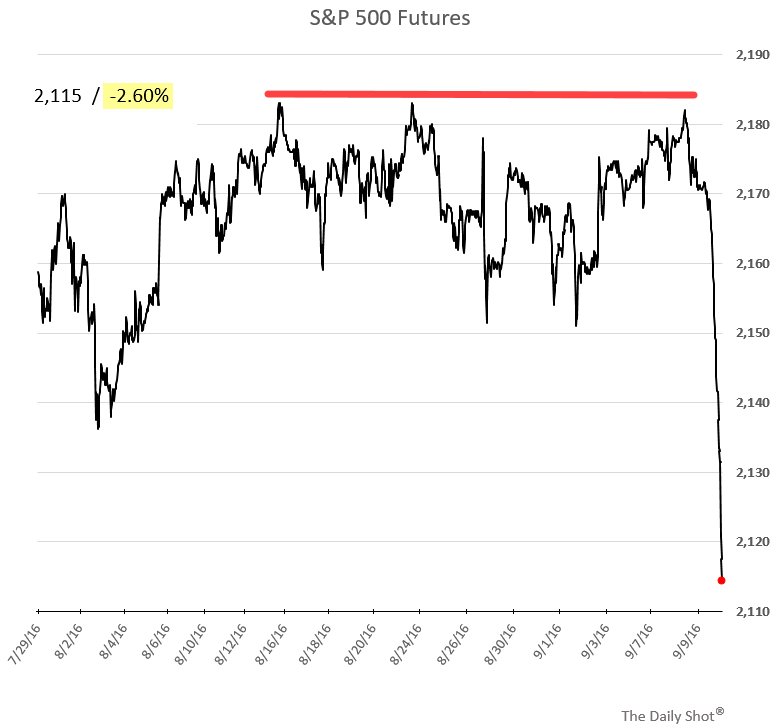

1. In the equity markets, the S&P500 futures closed 2.6% lower on the day. Some had been pointing to the “triple top” technical formation.

The selloff continues in the early Monday morning hours.

Source: barchart.com

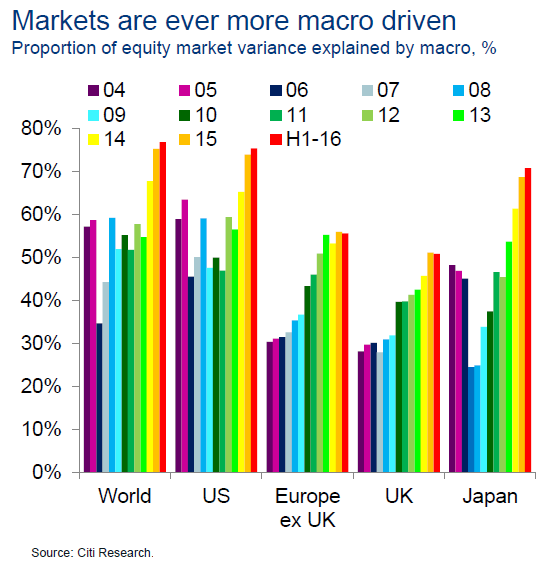

2. Citi has recently pointed out that global equity markets are increasingly macro-driven, and Friday’s events made that quite clear.

Source: Hans Lorenzen

3. With both bonds and stocks selling off, there was “nowhere to hide”. Only bank shares lost less than 1% – as the market telegraphs higher interest rates.

Source: Investing.com

4. To put Friday’s market action in perspective, the chart below shows daily moves in the S&P500 futures vs. long-term treasuries (TLO) over the past couple of years. Only the 12/3/15 move – right before the Fed’s hike – was comparable.

Source: Bloomberg

5. Charlie McElligott (RBC) says that low historical volatility (discussed here several times) has pushed the Risk-Parity folks into equities. As Friday’s (and possibly this week’s) moves make their way into the vol figures, we could see the unwind (a “procyclical” investment strategy). Note that a similar effect will show up in banks’ VAR models (with some lag), although the US banking system is less relevant in most markets these days.

Leave A Comment