We are watching Foot Locker (FL) very closely as it is a key component of the BAD BEAT Investing portfolio run by Quad 7 Capital. We believe 2018 is a make or break year for the name. The reason that we added the name to the portfolio and have made several successful trades in the stock is because of the horrendous price action which drove the stock down to deep value.

Source: Yahoo Finance, graphics overlaid by Quad 7 Capital and BAD BEAT Investing

We first issued an alert at $29 in the fall, and took some profits when the stock returned to the mid-$40 range. Then after the most recent earnings report, we again issued a trade alert at $31 a share. These swing trades have been successful, but the position is a value holding.

We are gladly holding this American staple as it pays a dividend that is raised every year. It currently yields 2.6%. The company is buying back shares. It is getting aggressive in its property management. And, even at $45 a share, the company is priced at a discount on forward earnings and a price-to-sales basis.

With that said, there are many critical metrics that we will be watching for in 2018, but in this column, we specifically want to talk about comparable sales, as this indicator alone could drive investors to sell, or bid up the name. There is no doubt about it, declining comparable sales are a key weakness for the company right now. Foot Locker has got to do better here.

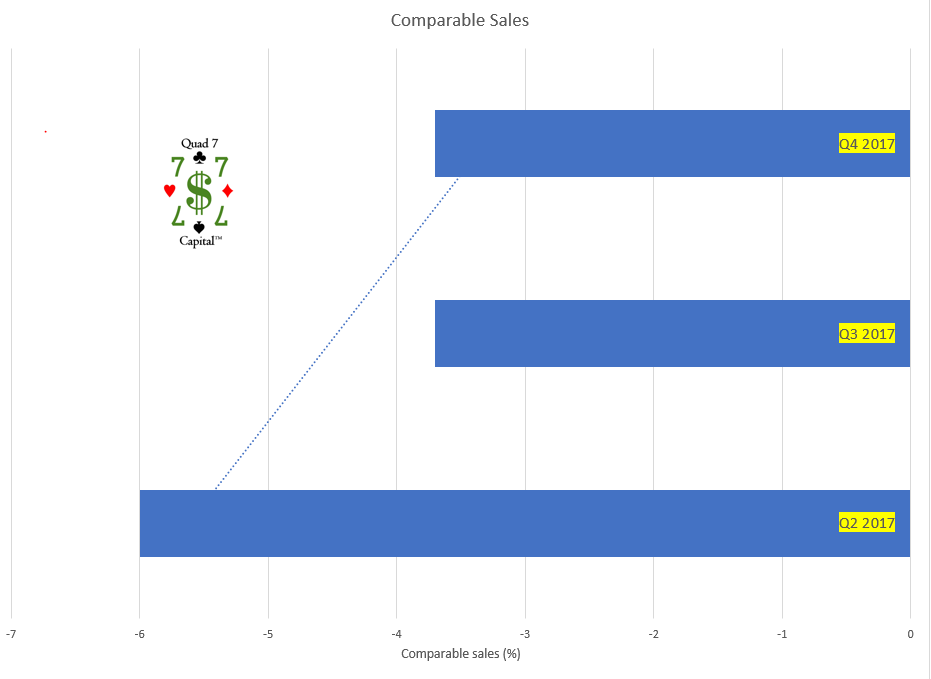

In fact, poor comps crushed Foot Locker, but we think this was overdone. We need to point our that for the year 2018, we are projecting flat-to-slightly positive same-store sales. It should be noted that we anticipated a weak start to the year on this metric, but comparable sales were below our projections of down 2-3%, coming in at -3.7%:

Source: SEC filings; chart made by author in MS Excel

While this may look a little scary, there is actually some good news here. First, comps appear to be in recovery mode as they are starting to trend higher off of the horrendous results last summer. In addition, we have great expectations for Foot Locker on this measure this year. Comparable sales are expected to ramp up from their lows seen in Q2 2017, where they fell a devastating 6%.

Leave A Comment