A report by the Schwab Center for Financial Research mentioned a trifecta of concerns drove stocks lower last week, including an announcement by the Trump administration that it would impose roughly $50 billion in tariffs on imports from China. The news came amid concerns about procedures social media firms use to protect the data of its users and potentially stricter government regulation of the sector, as well as a more hawkish tone from the Federal Reserve regarding future interest rate increases. “It looked much like a classic flight-to-safety situation, with utilities holding up while the more internationally focused areas such as industrials took a bigger hit,” says Brad Sorensen, managing director of market and sector analysis for the Schwab Center for Financial Research (SCFR). He cautioned about reading too much into the market correction. “The economy still looks strong and the upcoming earnings season should be solid,” Brad says.

It’s nearly impossible to time the market and tempting not to immediately sell based on recent market movements. This is why we strongly advocate hedging trades and/or include defensive assets, such as cash or bonds for stability. Also, it is smart to make sure your portfolio is adequately diversified and not overweight any particular sector, especially among many high-flying technology stocks, says Randy Frederick, vice president of trading and derivatives for Schwab. Technology shares are facing pressure and a potential trade war is still festering, so traders should exercise patience before they consider adding equity exposure,” Randy says.

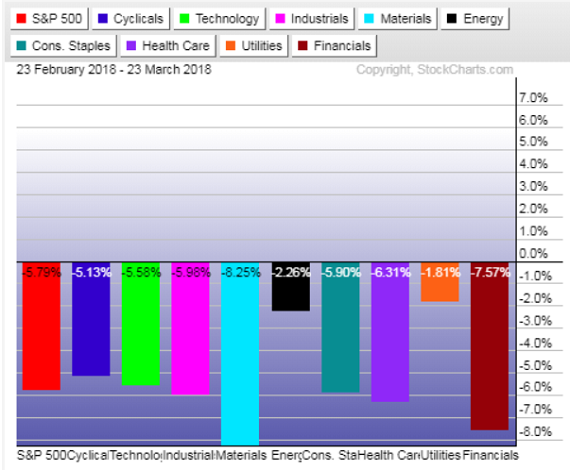

The updated graph below confirms the stock market is headed in correction mode. All the S&P sectors are crashing, but note that utilities are outperforming other groups. Utility stocks are considered defensive investments because of the stable dividend yields they provide.

Leave A Comment