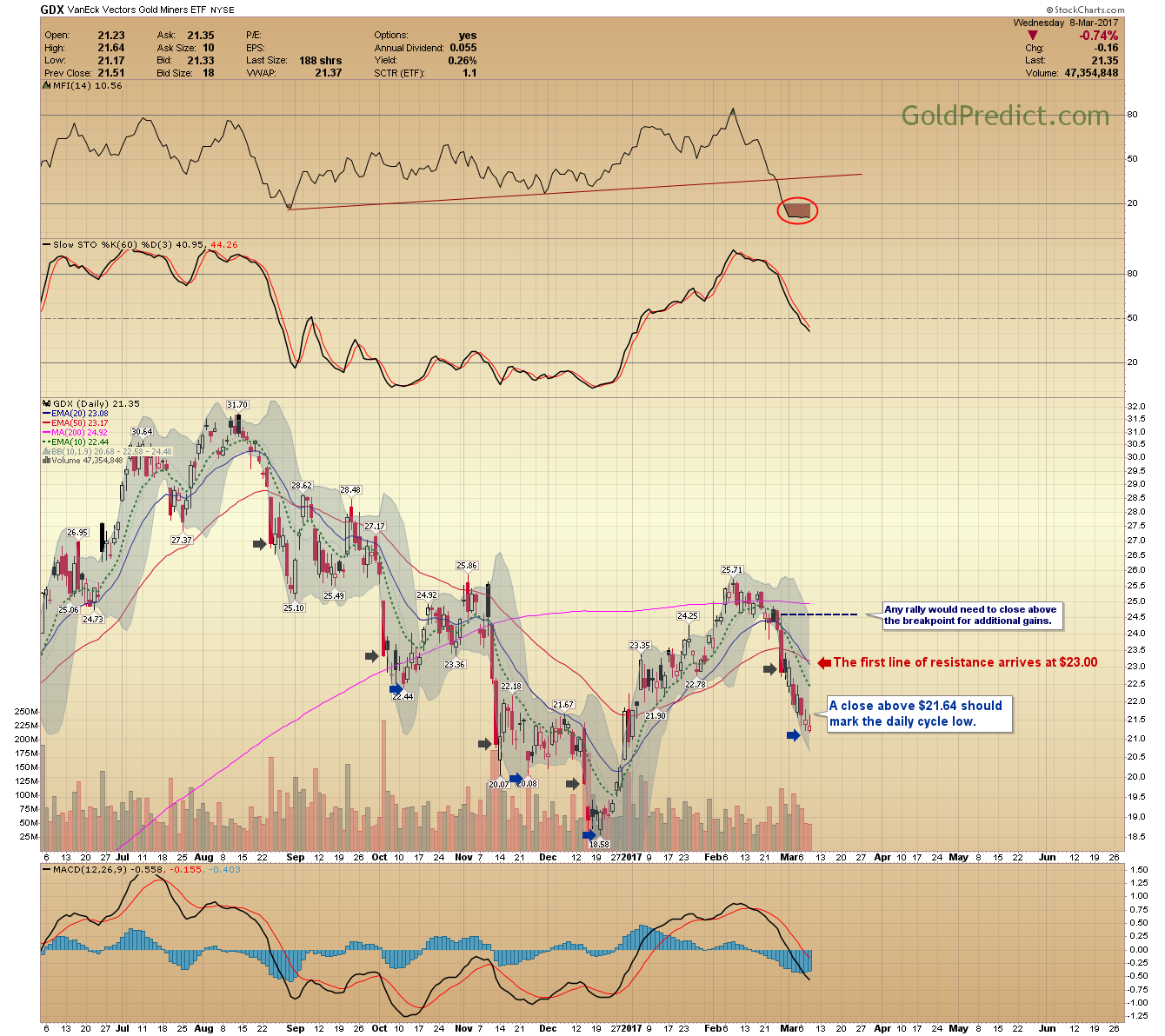

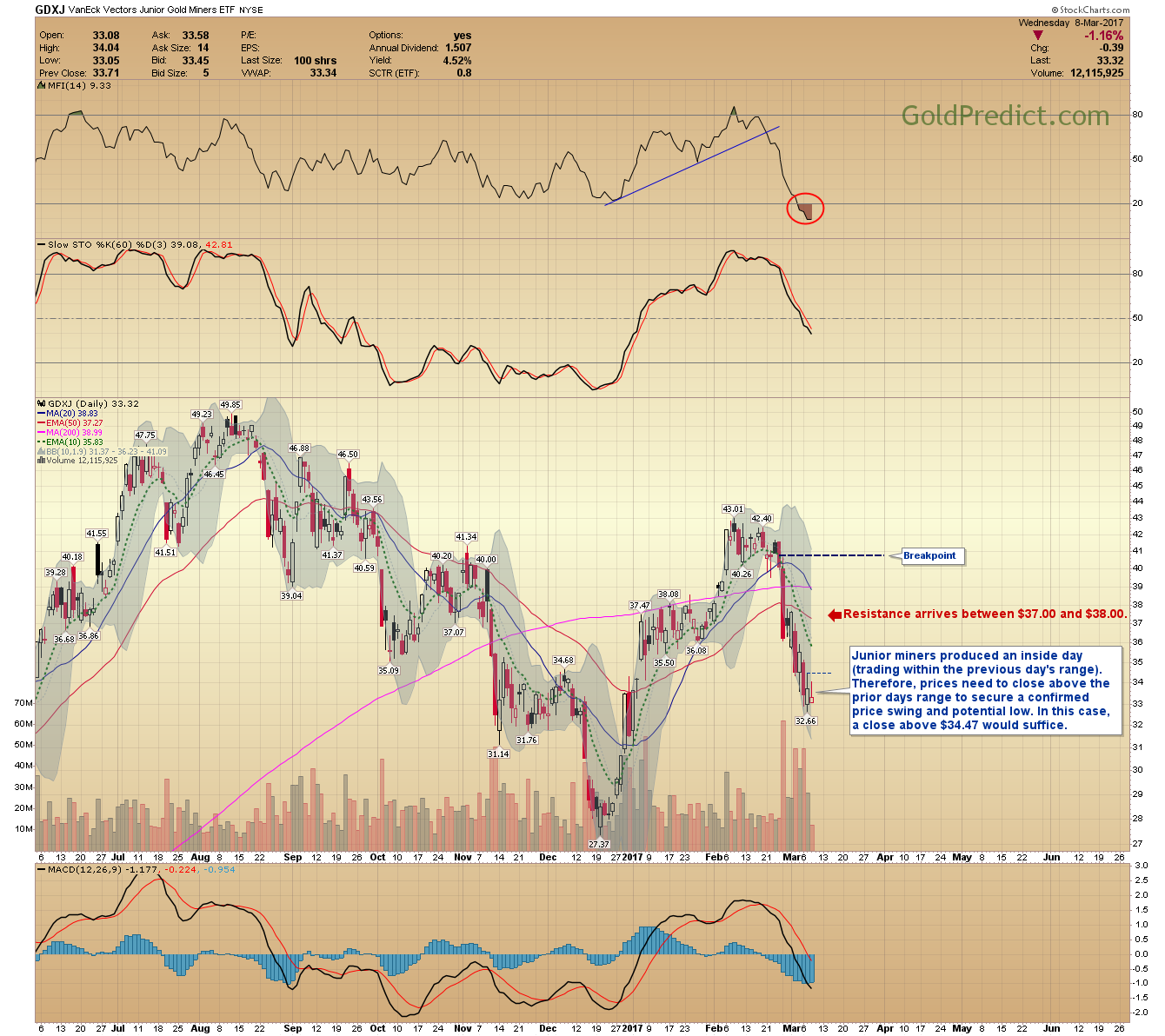

Each day we inch closer to a daily cycle bottom in metals and miners. Prices are far enough from the recognition day that any close above the previous day’s high should signal the low. How prices bounce/rally out of the approaching low will determine the next 2-3 months.

-GDX- A close above $21.64 should mark the daily cycle low.

-GDXJ- Junior miners produced an inside day (trading within the previous day’s range). Therefore, prices need to close above the prior days range to secure a confirmed price swing and potential low. In this case, a close above $34.47 would suffice.

-WTIC- Oil prices confirmed an intermediate top and generated a recognition day immediately after our short entry. I’m moving my stop down to $53.14. Prices could bounce off the 200-day MA, but we should see continued weakness and a test of the November low ($42.20), sometime this Spring.

Metals and Miners are close to an intervening low, but the odds favor even lower prices in May or June. Employment numbers come out tomorrow, and the FED meeting is next week. The probabilities for aMarch rate hike have risen to 90%.

Nevertheless, I think an even bigger predicament arrives when the debt ceiling is capped March 15th. I’m not sure how this drama will play out, but March and April could see heightened volatility.

Leave A Comment