One investing school of thought is that you should find an amazing investor and ride his or her coat tails to fun and profit.

This certainly worked out well for those who bet on history’s greatest investor, Warren Buffett, by investing in Berkshire Hathaway (BRK-A, BRK-B). You can view Buffett’s high dividend stock portfolio here.

After all, if you invested $10,000 in Berkshire in 1965, your position would be worth a staggering $88 million today.

Of course, the odds that Buffett can recreate that kind of success in the coming years is all but impossible due to the massive size of Berkshire; something he himself freely admits.

However, there are still ways for investors to invest alongside legendary investors, including private equity and hedge fund legends such as Carl Icahn, who is the 38th richest person on earth with a net worth of $19.4 billion.

Icahn runs his empire via a master limited partnership (MLP) called Icahn Enterprises (IEP).

While Icahn Enterprises offers regular investors the opportunity to invest alongside one of the most well-known investors in history and enjoy a 12% yield to boot, this MLP comes with plenty of risks.

Let’s take a closer look to see if the risks make it unsuitable for most dividend growth investors, especially those needing steady income in retirement.

Business Overview

Unlike most MLPs, which generally are involved with energy gathering, transportation, and processing, Icahn Enterprises is a diversified conglomerate that Icahn uses to help raise investor capital for his activist investing empire.

Icahn’s empire owns stakes in 11 different industries (he recently sold his position in Trump Entertainment to avoid conflicts of interest to join the administration) including: auto parts makers, energy companies, casinos, miners, food packaging companies, industrial companies, and real estate.

Unlike most MLPs, Icahn Enterprises has no general partner or incentive distribution rights.

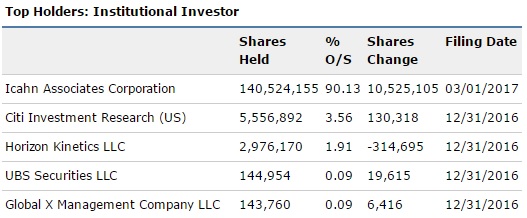

That’s because, while 99% of the MLP is owned by limited partners, Icahn himself, via Icahn Associates, owns just over 90% of the MLP’s units (and chooses to be paid in new units instead of cash).

This structure helps to ensure that Icahn’s stake will rise over time and will always grant him absolute control over the MLP.

In other words, any investor in Icahn Enterprises is basically agreeing to have no say in the management of the partnership but is trusting that one of history’s greatest activist investors can continue growing his empire, and thus, their wealth over time.

Finally, it’s important to realize that while Icahn Enterprises is highly diversified in the number of industries it invests in, the vast majority of revenue, and Adjusted EBITDA comes from its automotive, energy, and railcar holdings.

Meanwhile its investment arm generates highly volatile revenues and earnings, which is par for the course in the hedge fund and private equity world.

Leave A Comment