Our contention behind “residual seasonality” has always been that there is no residual but to some extent an understandable and easily explainable seasonal issue. Each Q1 appears to be unusually weak because, well, it is unusually weak. The reason is simply Christmas. Americans splurge for the holiday and then spend the first several months of the following year to some degree regretting it.

It’s all the worst given that the splurge part has since 2011 been stretching the word to a significant extent. It pertains only to the degree which consumers spend with respect to their individual budgets, these constraints that are tied to non-existent income growth. That’s what makes the backlash each Q1 so frustratingly weak.

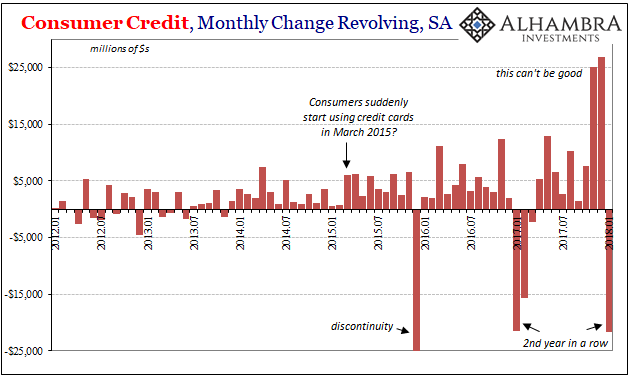

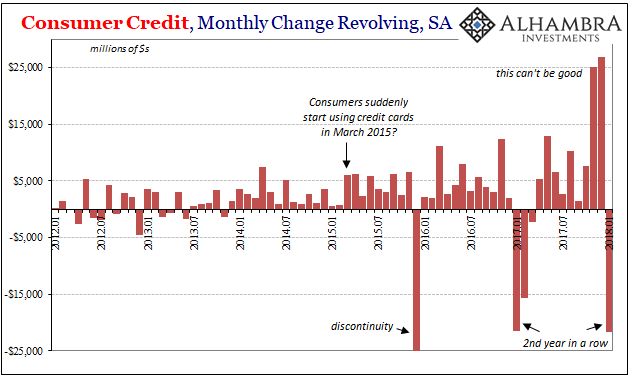

The influence and appeal of revolving credit in this process is a relative latecomer. Starting in the middle of 2015, aggregate reported revolving credit balances began to rise just in time for that Christmas. A data discontinuity in December 2015 renders any analysis along these lines for that particular year moot.

There was in November 2016, however, a large increase in revolving balances, followed by a smaller one the following month. Starting in January 2017, however, revolving credit balances plummeted, and for a second month last February, therefore suggesting that our arguments for residual seasonality may have held for the very weak Q1 last year.

As noted over the past several months, the Federal Reserve reported massive increases in revolving credit for both November and December 2017 – just in time for last year’s holiday shopping period. Given that income growth has been continuously weak since the 2015-16 downturn, those historically large increases would appear to have been in response to lack of wage gains and income growth in still keeping with the intent to splurge as much as possible for Christmas – and the inability to do so on earned income alone.

The Fed’s consumer credit update yesterday shows us what we have expected, namely that in January revolving credit balances have declined by a huge amount. Similar to January 2017, the apparent drawdown in revolving credit fits with economic weakness recorded in PCE estimates, retail sales, as well as, importantly, the overall the Personal Savings Rate.

Leave A Comment