If you thought Elon Musk (or as we like to call him in these quarters “Elon da Vinci”) was a dead man walking, you were wrong. Like Wile E. Coyote in the Road Runner cartoon, Musk can fall a thousand times off a thousand cliffs and never die.

After Tweeting that Tesla (TSLA) had funding to take the company private at $420 back in August, he has since settled charges with the Securities and Exchange Commission (SEC) for misleading investors. Musk agreed to pay a $20 million fine and relinquish his role as Tesla’s chairman for three years. For perspective, Elon’s net worth hovers around $20 billion, so a $20 million fine is spare pocket change.

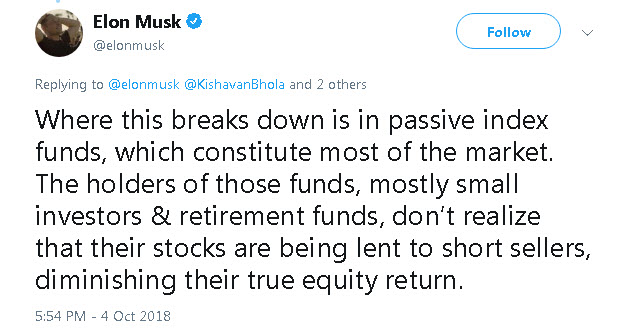

More importantly, Elon is reborn and emboldened. And his new target is an odd one – index funds.

The Index Fund Blame Game

In a series of angry Tweets sent on Oct. 4, Musk blamed the securities lending done by index funds and ETFs with having “no rational basis.” He also claimed it gives short sellers a “strong incentive” to attack publicly traded companies. Moreover, he inaccurately stated that passive indexing accounts for most of the stock market investing done today. In SpaceX terms, Elon has air-lifted into another solar system.

Indexing is Big…but NOT that BIG

While it’s entirely true that index investing has gone mainstream, (heck, there’s even an “Index Investing Show” which I host.) it does not represent “most of the market” as Elon inaccurately claims.

The chart below from the Investment Company Institute shows that index mutual funds along with ETFs own a minority percentage of U.S. stocks by market capitalization.

Moreover, it will take yet several years more before the assets held in index funds surpass actively managed mutual funds. According to one estimate, Moody’s Investors Service projects it will take approximately three to six years more before indexing even comes close to overtaking actively managed strategies.

Leave A Comment