In a previous article, we showed a chart which had central bank tightening listed as a contributing factor for 29 out of the past 45 recessions in G7 nations. This article will review the latest Fed policy in a quantitative manner. First, let’s review the policy prescription that has all investors and economists talking. The concept is to hike rates ‘until something breaks’. The idea is the Fed will hike rates regardless of GDP growth trends or inflation and only stop when there’s damage to the economy.

This policy seems like an unforced error because if inflation is low, forcing us to ask the question: “Is the economy is even late cycle” in a previous article, there’s no reason to hike rates to the point where they cause the economy to slow. As investors having philosophical debates over the best policy will not help us react to it, regardless of whether we agree or disagree with it. Instead, we need to understand the reality of events and the best ways to be proactive, taking into account potential risks. The Fed is getting close to neutral policy as we discussed previously. Once it gets above the neutral rate, monetary policy slows the economy. The hawkish monetary policy could combine with the negative effects of the stimulus wearing off to bring down growth in 2019.

Fed At Neutral Rate

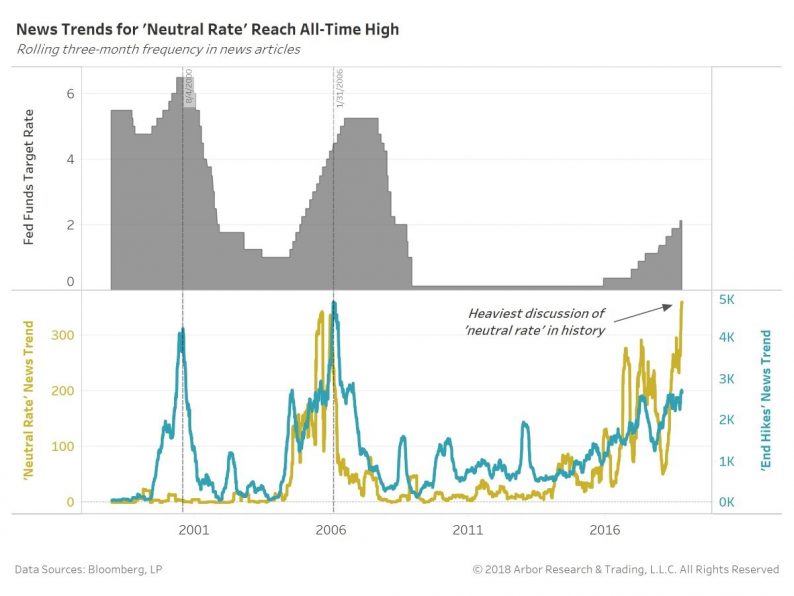

As we mentioned, this article measures policy quantitatively. The chart below shows the Fed funds rate along with news trends of articles about the end of rate hikes and the neutral rate.

Source: Arbor Research

Discussion of the neutral rate is the highest ever, but keep in mind the term only became prevalent towards the end of the last cycle. The biggest signal the Fed has neutral rates is the elimination of the word ‘accommodative’ in its statement.

In the latest Minutes from the September meeting, the Fed explained why it eliminated that term. It said the term suggests “a false sense of precision” of where the rate might be. Including “accommodative” was not “providing meaningful information in light of uncertainty surrounding the level of the neutral policy rate.” The Fed is saying the Fed funds rate is close enough to the neutral rate that it didn’t feel comfortable with keeping the term ‘accommodative’. The policy might still be stimulative after a couple more rate hikes, but the Fed doesn’t know for sure because the neutral rate is only an estimate.

Leave A Comment