Equities Talking Points:

NOT A SUMMER FOR LULLS, BUT WE NEAR THE END NONETHELESS

US stocks have started to show some element of pullback as we wind down the week, and this comes on the heels of a breakout to fresh highs that ran into Wednesday trade. As we looked at in the Dow yesterday morning, Dow Tests Short-Term Support as Month-End Nears.. But – those bullish themes in US stock remain attractive while a more questionable backdrop has appeared on number of indices outside of the US. In this article, we’ll take a trip around the globe in looking at stocks in the UK, Europe and Japan to go along with US issues.

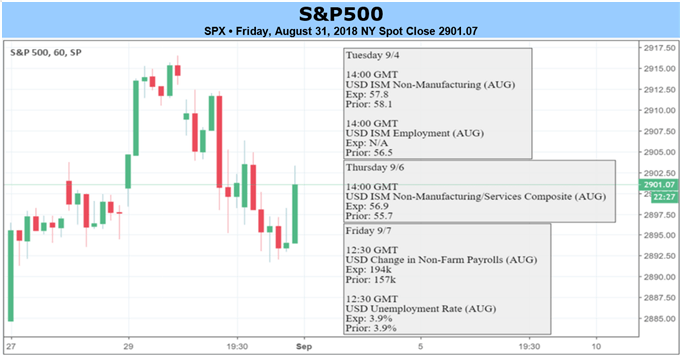

Next week brings a number of interesting items on the economic calendar, and it’s important to note that next week begins with a holiday in the United States. Monday marks Labor Day, which is commonly looked at as the end of the summer months and the return of liquidity to financial markets as traders arrive back at their desk to finish out the year.

S&P 500 ACCELERATING UP-TREND PUSHES UP TO FRESH ALL-TIME HIGHS

The first part of the week was marked with strength, and the final two days saw prices pullback from fresh all-time-highs. Given the veracity of the move over the past two months, traders would likely want to move forward with a bullish bias at this point, as topside structure remains intact and, as of yet, has shown no signs of giving way. This puts focus on potential areas of higher-low support for strategies of bullish continuation, with the obvious next point of interest at the prior all-time-high around 2875.

This level can be somewhat of a trap, however, as it’s a very obvious swing-point on the chart that didn’t really elicit much for resistance as prices were working higher. Last Friday saw prices close below this level and then this Monday, prices gapped-above and didn’t even check back for support; so its usability moving-forward remains in question. The price that does carry some attraction for long strategies is around 2860, as this was a batch of resistance earlier in the month of August that came-back later in the month. As of yet, we haven’t seen a support check here, and this remains interesting for higher-low support.

Leave A Comment