Oil recovered slightly yesterday and is currently trading above $38 per barrel although the black gold remains under pressure. Soft trade numbers from China on Tuesday highlighted the struggle facing the worlds’s 2nd largest economy, only serving to confirm concerns over cooling demand.

Asian stocks were trading slightly lower this Wednesday morning reflecting current sentiment amongst the world’s fiancial markets. Commodity currencies continue to be worst hit with USD/CAD trading at 11.5 year highs. AUD/USD recovered from its 0.7186 low yesterday, currently trading around the 0.7225 mark.

EUR/USD remains bullish, currently trading back above 1.09, whilst JPY made early gains this morning on the greenback following significantly better than expected machine orders data from Japan. Elsewhere, USD remains dominant with modest gains against most currencies.

Today we have the

RBNZ cash rate and rate statement announcements which will be realeasd at 8pm GMT, so expect possible action on NZD crosses. Oil inventories at 3.30pm GMT is the only other highlight of the day.

Trading quote of the day:

“There is only one side of the market and it is not the bull side or the bear side, but the right side.”

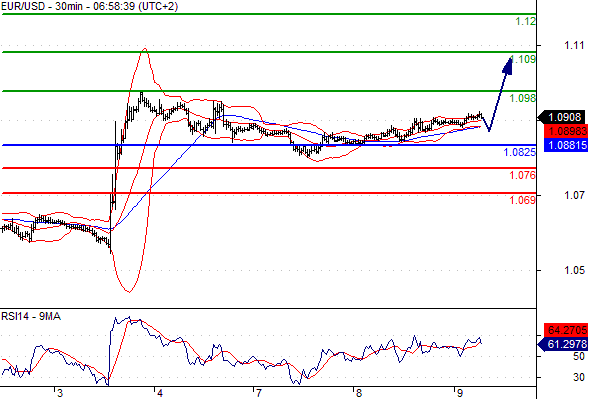

Green lines are resistance, Red lines are support.

EUR/USD

Pivot: 1.0825

Likely scenario: long positions above 1.0825 with targets @ 1.098 & 1.109 in extension.

Alternative scenario: below 1.0825 look for further downside with 1.076 & 1.069 as targets.

Comment: technically the RSI is above its neutrality area at 50.

GBP/USD

Pivot: 1.5055

Likely scenario: short positions below 1.5055 with targets @ 1.4955 & 1.4905 in extension.

Alternative scenario: above 1.5055 look for further upside with 1.509 & 1.5115 as targets.

Comment: the RSI lacks upward momentum.

AUD/USD

Pivot: 0.725

Likely scenario: short positions below 0.725 with targets @ 0.718 & 0.715 in extension.

Alternative scenario: above 0.725 look for further upside with 0.7285 & 0.732 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Leave A Comment