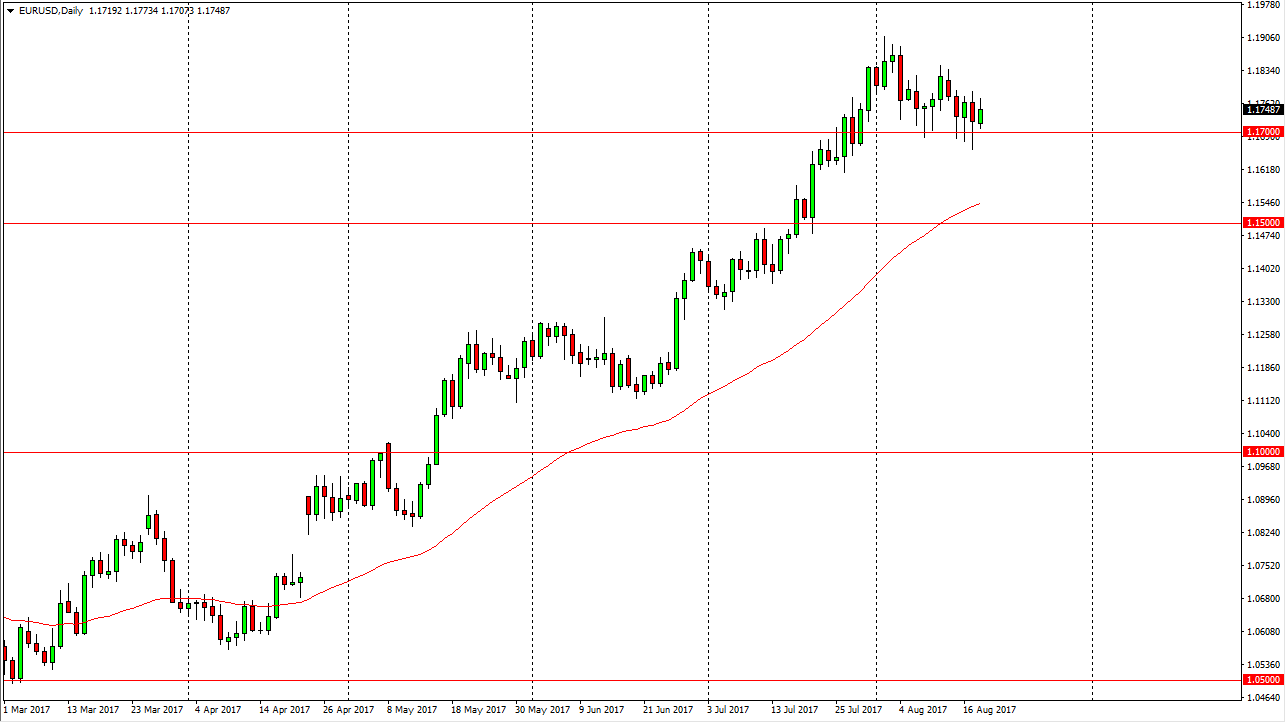

EUR/USD

The EUR/USD pair use the 1.17 level for stability on Friday, as we continue to find buyers in this general vicinity. Because of this, I believe that the market is going to rally given enough time, perhaps reaching towards the 1.19 level above. I think that there is a significant amount of resistance from there to the 1.20 level though, so I expect volatility above. If we did breakdown below the lows of the Thursday session, the market will probably go looking towards the 1.15 level for support. Currently, I have no plans on selling this market as it seems like the buyers have staked their claim in this market, and that the US dollar continues to sell off in general. Breaking above the 1.20 level is going to take a significant amount of support though, so I do not anticipate that it’s going to be easy.

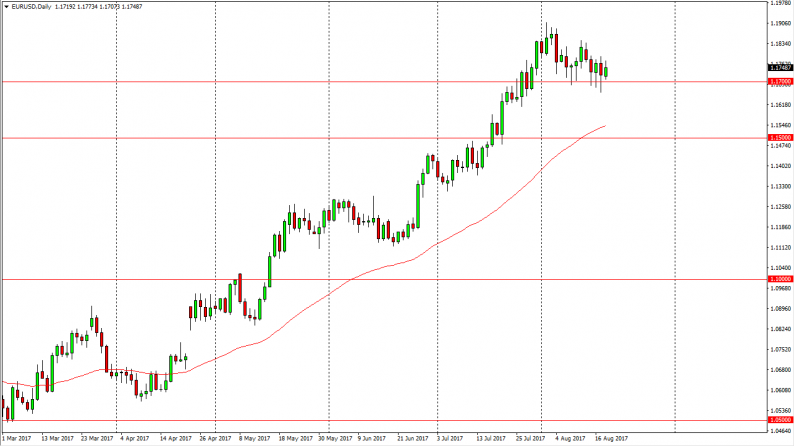

GBP/USD

The British pound went back and forth during the day on Friday, hovering above the 1.2850 level. The market looks as if it is trying to decide where to go next, and quite frankly I think that a break below the bottom of the candle would be very bearish, perhaps sending this market down to the 1.26 level. Alternately, if we can break above the top of the candle, that should send this market looking towards the 1.30 level longer term. I think that there is still more bearish pressure than bullish in this market, so having said that it’s likely that we will continue to see sellers jump in and I would find it very surprising if we can break above the 1.3050 level, which would become more of a “buy-and-hold” type of move just waiting to happen. Ultimately, I believe that the British pound has major issues.

Leave A Comment