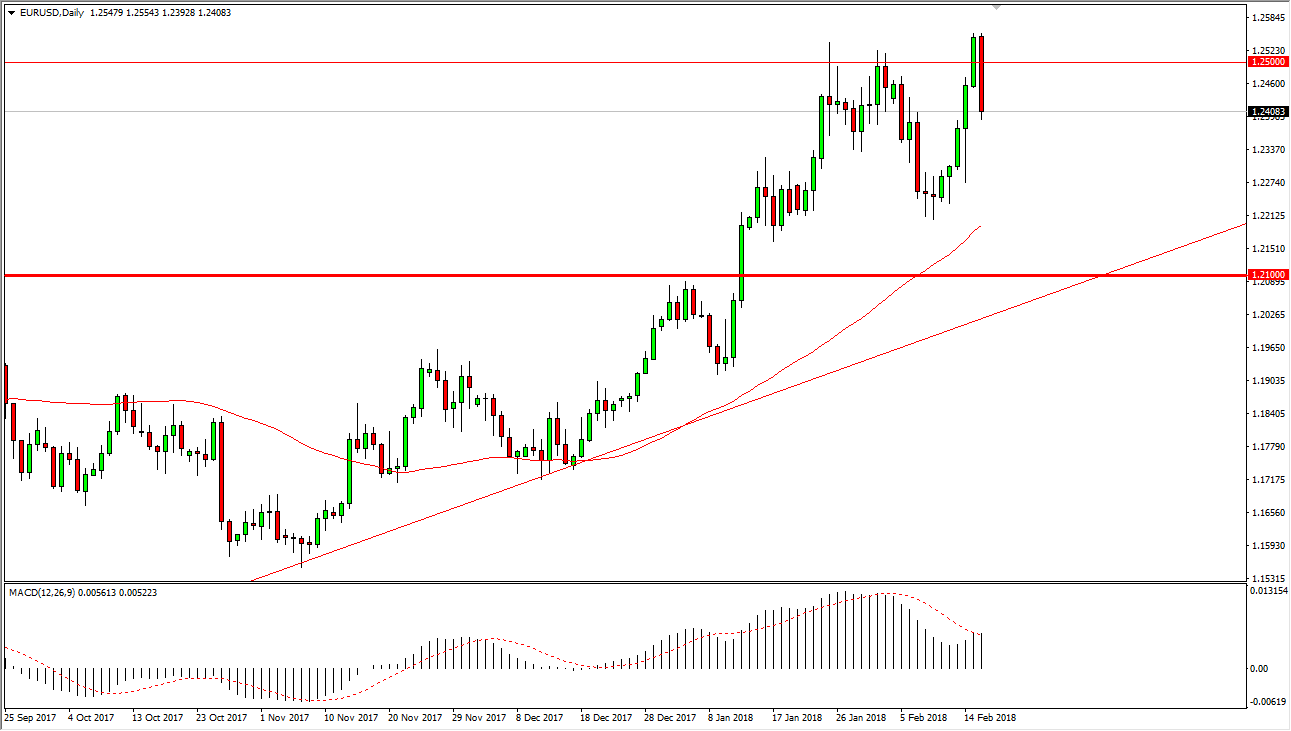

EUR/USD

The EUR/USD pair has fallen rather precipitously during the trading session on Friday, breaking through the 1.25 level as it was suggested by the ECB that interest rates will not rise until after quantitative easing is stopped. That gives us a much longer time line for higher rates out of Europe, so it makes sense that we got a bit of a pullback. However, I think that the uptrend is most certainly intact still, and I think that eventually the buyers will continue to jump in this market. I think the 1.21 level is the “floor” in the uptrend, so it’s not until we break down below there that I become concerned or would even consider selling. However, I certainly don’t want to jump in now. I’m waiting to see some type of bounce or supportive candle that I can take advantage of to pick up value.

GBP/USD

The British pound also fell during the day, reaching down towards the 1.40 level. However, unlike the Euro, we found support at a reasonable level, and I think that the buyers will probably come back in relatively soon. Ultimately, I think that the market will bounce towards the 1.43 level given enough time, but I think that it’s very unlikely that it will be easier to get there, and it will more than likely be a choppy short-term trader’s type of adventure. If we break down below the 1.40 level, I think that the 1.39 level underneath will be supportive as well. The 50 day exponential moving average is just below, and I think that also offers dynamic support. In other words, I’m a “buy only” trader, but I recognize we may have a bit of noise to contend with in the meantime.

Leave A Comment