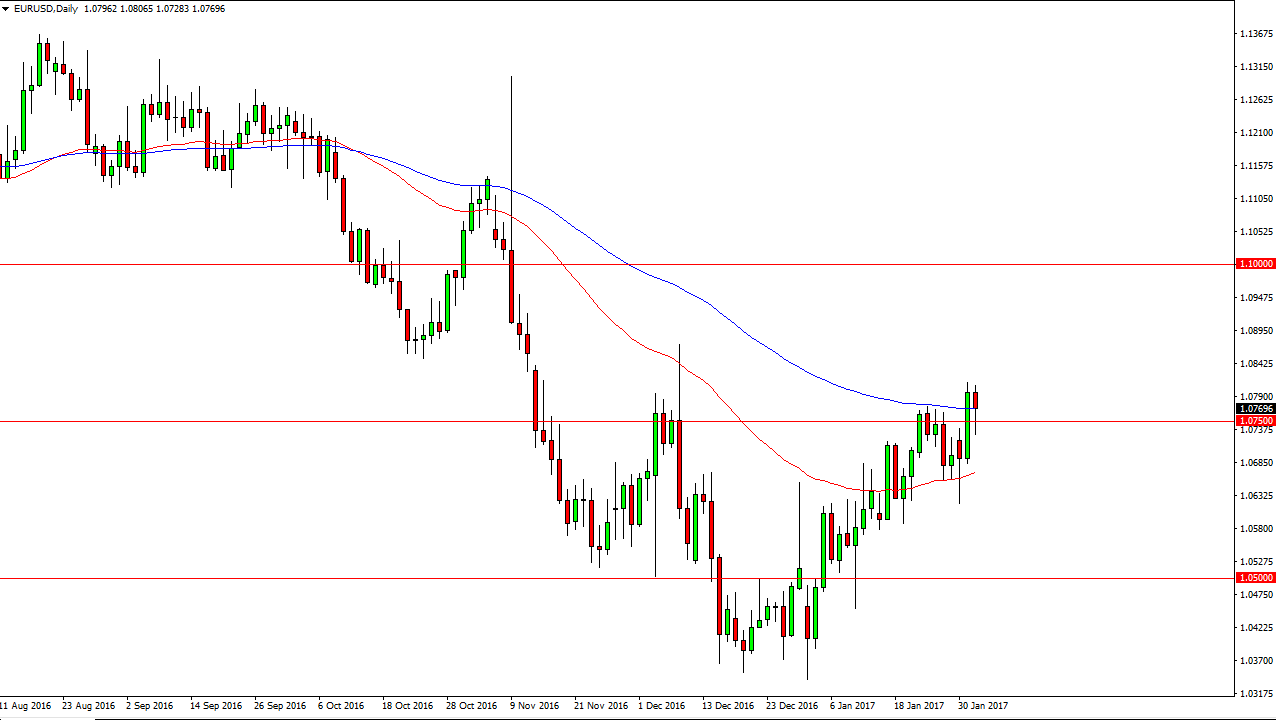

EUR/USD

The Euro initially fell against the US dollar during the session on Wednesday but found enough support below the 1.0750 level to form a hammer like candle. As we are sitting on top of the 100-exponential moving average, it is my belief that a break above the top of the daily candle should send this pair higher. I think if we can stay above the 100-exponential moving average we will try to reach the 1.0850 level above, and then eventually the 1.10 level after that. Alternately, I don’t have any interest in selling until we break below the 50-day exponential moving average below, and thus I am only looking for short-term buying opportunities now. With this being the case, I remain slightly optimistic.

GBP/USD

The British pound initially fell on Wednesday but found enough support below to turn things around to form a rather bullish looking candle for the session. If we can break above the top of the candle, and I think we will sooner rather than later, we should then test the 1.2750 level above. I believe that is a major area and if we can get above there, the British pound has bottomed. This would be a major trend change, and could lead to a very long-term buying opportunity, or at the very least the opportunity to buy the pound on the dips. Alternately, we breakdown below the 1.24 level, which is looking increasingly unlikely, then the market will probably reach towards the 1.20 level underneath there.

I am a firm believer in that the Forex markets overreacted to the United Kingdom leaving the European Union, and thus I think this bounce has been coming. I believe that the so-called “smart money”, has been buying the British pound every time it dips. The impulsive candle from a couple of weeks ago, shows just how strong the attitude changed on that day.

Leave A Comment