EUR/USD reached new highs only to fall sharply as Italy’s budget came to the forefront. The issues are far from being resolved. PMI data stands out in the first week of Q4. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Italian government decided on a budget deficit of 2.4% of GDP, higher than what the technocratic finance minister Giovanni Tria wanted, 1.6% and more than the EU wanted. The plunge in Italian stocks and bonds weighed heavily on the euro but the populists’ parties that govern the euro zone’s third-largest economy are not impressed. Core inflation disappointed with 0.9%. On the other hand, ECB President Mario Draghi was bullish on the prospects of core inflation rising up and on the acceleration in wages. In the US, the Fed raised rates as broadly expected and signaled four rises until the end of 2019. However, the removal of the words “accommodative policy” initially hurt the greenback. Fed Chair Powell’s optimistic message and his clarification that the outlook had not changed eventually sent the greenback higher. US data was mixed, yet mostly positive.

Updates:

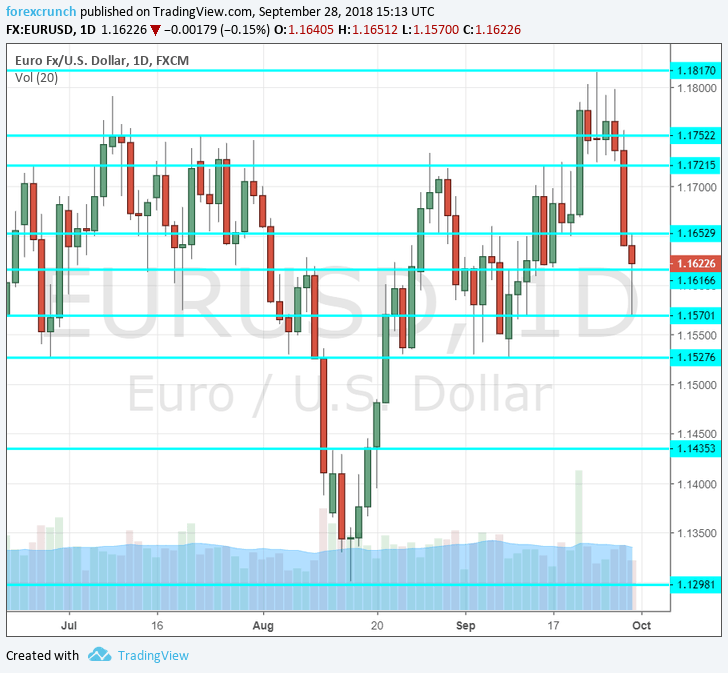

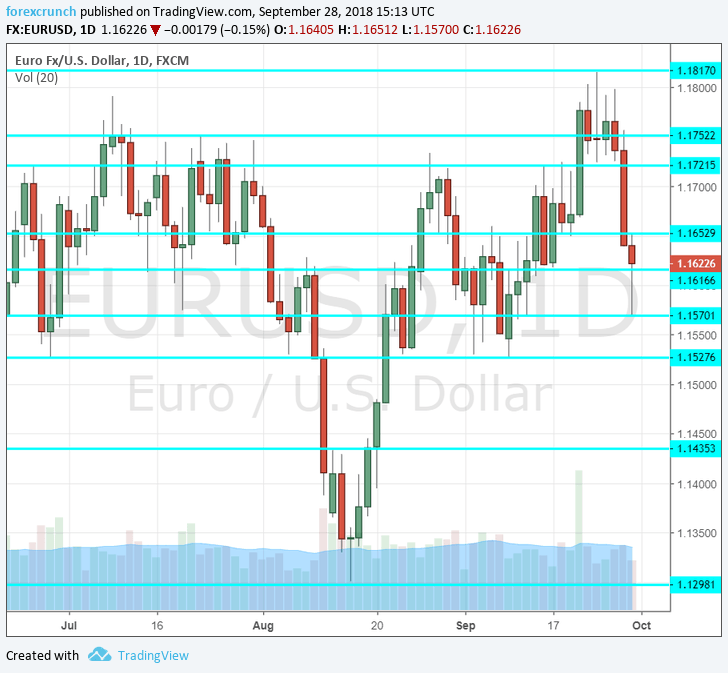

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

Leave A Comment