Video Length: 00:07:54

.The US Dollar is turning back higher today following small losses to start the week, as attention is quickly shifting from the USD-negative political chaos in Washington, D.C. to the expected USD-positive economic developments over the coming days.

Even though market participants are widely dismissing tomorrow’s FOMC meeting as a meaningful event – there is a 0% chance of a rate hike, per Fed funds futures – the simple confirmation of the intention to raise rates next month should at a minimum buoy the greenback. Likewise, with a very strong October US Nonfarm Payrolls report due on Friday (really just a ‘give-back’ number after Hurricanes Harvey and Irma impacted the September report), the market mood is still looking favorable for the US Dollar.

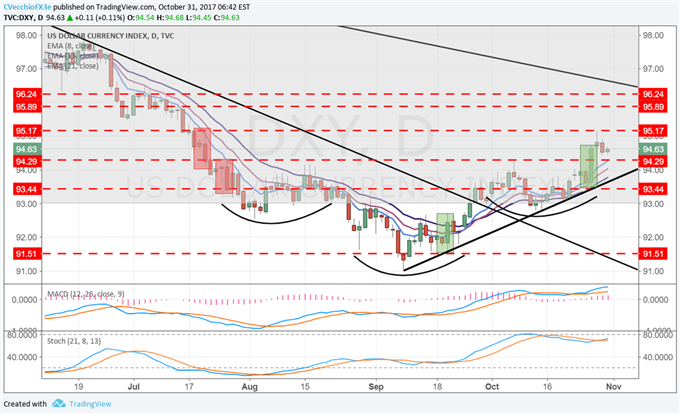

Significant technical advances were made by the DXY Index last week with the close through 94.29, the July 26 bearish outside engulfing bar and neckline of the inverse head & shoulders pattern that has formed over the past three months. With the daily 8-, 13-, and 21-EMA moving average envelope rising into the neckline, it appears this level is firming up as key support as we turn into November.

Chart 1: DXY Index Daily Timeframe (June to October 2017)

Accordingly, with the Euro constituting 57.6% of the DXY Index, it’s no surprise then that the EUR/USD head & shoulders pattern remains valid against 1.1663. The rest that came yesterday proved fruitless, and the batch of mixed Euro-Zone GDP and inflation data earlier today has done no favors for the Euro to help it shake off the bearish sentiment emanating from the ECB meeting last Thursday.

Leave A Comment