EURO TALKING POINTS

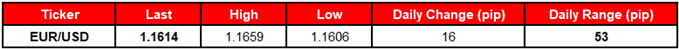

EUR/USD climbs to a fresh weekly-high (1.1659) even as data prints coming out of the euro-area instill a weakened outlook for the monetary union, and recent price action warns of a larger advance as the exchange rate initiates a fresh series of higher highs & lows.

EUR/USD INITIATES BULLISH SERIES DESPITE DISAPPOINTING EURO-AREA DATA

EUR/USD appears to be unfazed by the 0.9% decline in German Factory Orders, and the resilience in the single currency may persist ahead of the next European Central Bank (ECB) meeting on September 13 as the Governing Council appears to be on course to wind down the quantitative easing (QE) program ahead of the December deadline.

Even though the ECB remains in no rush to remove the zero-interest rate policy (ZIRP), President Mario Draghi and Co. may show a greater willingness to conclude its easing-cycle as the central bank pledges that ‘after September 2018, subject to incoming data confirming our medium-term inflation outlook, we will reduce the monthly pace of the net asset purchases to €15 billion until the end of December 2018 and then end net purchases.’ In turn, the ECB may adopt a less-dovish tone as ‘underlying inflation is expected to pick up towards the end of the year,’ and the Governing Council may unveil a more detailed exit strategy as the ‘uncertainty around the inflation outlook is receding’.

With that said, a material change in the ECB’s forward-guidance may generate a further shift in EUR/USD behavior, with the exchange rate at risk of extending the recovery from the 2018-low (1.1301) as it carves a fresh series of higher highs & lows.

EUR/USD DAILY CHART

Leave A Comment