– Euro-Zone 4Q GDP to Expand Annualized 1.5%.

– Euro-Zone Growth to Slow for First Time Since 2Q 2014.

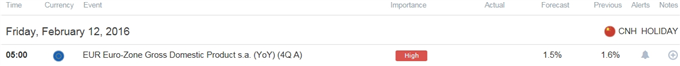

Trading the News: Euro-Zone Gross Domestic Product (GDP)

The Euro-Zone’s 4Q Gross Domestic Product (GDP) report may produce near-term headwinds for the Euro as signs of a slowing recovery puts increased pressure on the European Central Bank (ECB) to further embark on its easing cycle at the March 10 meeting.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:The ECB may enlist more non-standard measures to further insulate the monetary union amid the disinflationary environment across the major industrialized economies, and President Mario Draghi may continue to push monetary policy into unchartered territory in an effort to achieve the central bank’s one and only mandate for price stability.

Expectations: Bearish Argument/Scenario

Release

Expected

Actual

M3 Money Supply (YoY) (DEC)

5.2%

4.7%

Business Climate Indicator (JAN)

0.40

0..29

Construction Output (MoM) (NOV)

—

0.8%

Waning confidence accompanied by the slowdown in private-sector lending may drag on the growth rate, and a dismal 4Q GDP report may dampen the appeal of the single currency as it boosts bets for additional monetary support.

Risk: Bullish Argument/Scenario

Release

Expected

Actual

Retail Sales (MoM) (DEC)

0.3%

0.3%

Unemployment Rate (DEC)

10.5%

10.4%

Trade Balance s.a. (NOV)

21.0B

22.7B

Nevertheless, improved demand from home & abroad may encourage a stronger-than-expected GDP print, and signs of a more robust recovery may prompt the Governing Council to endorse a wait-and-see approach in March amid the bright signs coming out of the economy.

Leave A Comment