International Markets Drive Revenue Growth

It’s not a surprise the small caps, which are mostly domestically focused, have lagged the S&P 500 in terms of margin expansion and revenue growth because the domestically focused firms in the S&P 500 have had slower growth than international firms for the past few quarters of this expansion. This is partially because American growth is lower than global growth and partially because most tech companies have a high international focus and that sector is a growth engine. Low growth sectors like telecom, utilities, and real estate have a high domestic focus.

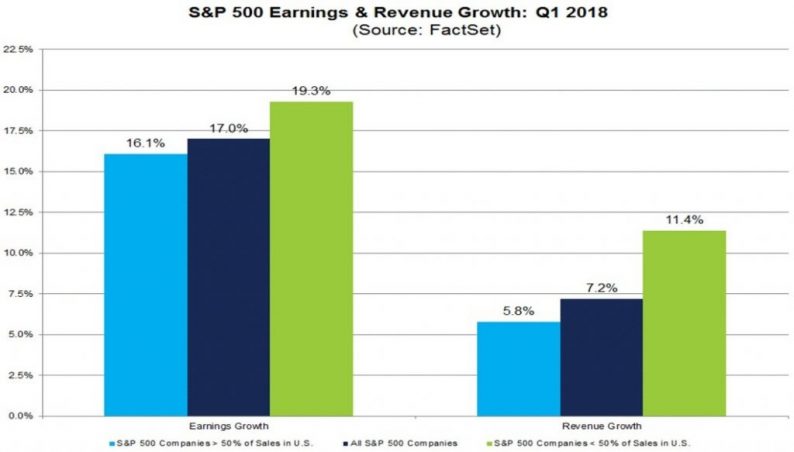

The chart below shows the Q1 estimates for earnings and revenue growth for domestically focused and internationally focused firms. As you can see, the difference between international earnings growth and domestic earnings growth is 3.2%. Clearly, the difference has tightened because the principal catalyst for earnings growth in both groups is the tax cut. The revenue growth difference is 5.6% showing that the domestically focused firms are seeing more margin expansion than international firms and that the growth outperformance for international markets will continue.

The earnings expectations for Q1, 2018, and 2019 were all stagnant in the past week. They are about to start falling in the next few weeks. On the one hand, stocks have rallied in previous years when earnings expectations have fallen. On the other hand, stocks seem to be affected by the negative headlines more this year which means the positive catalyst of increasing earnings estimates not being there to boost stocks is particularly damning. Personally, I’m fine with buying stocks if earnings growth 10%-15% rather than the expected 18% growth. That being said, I expect the market to be range-bound since the economic data has been weak in February.

One misleading point the financial media is making is that the tariffs and volatility in the White House are the only reason stocks have been weak in the past 6 weeks. The reality is the economic data is playing an important part in this range bound market. If my assertion is correct, the market might be range bound for the next few months because that’s when I think the economic data will improve. Earnings growth expectations will slow their decent in the 2nd half of the year because the economy will be stronger than the first half.

Leave A Comment