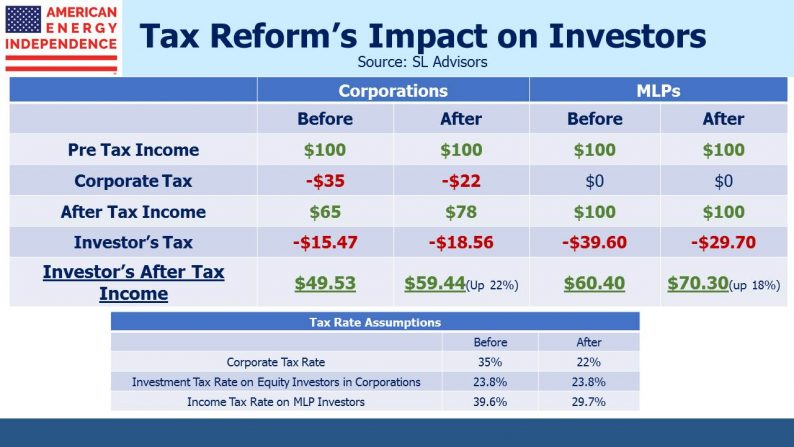

Tax reform removed the uncertainty surrounding treatment of MLPs, in that both House and Senate plans provide some additional benefit. Although the final bill will require negotiations to reconcile the different Senate and House versions, we’ve updated the table below to reflect a 22% corporate tax rate and the Senate treatment of pass-through income for MLP investors, which is less attractive than the House. Investors in both C-corps and MLPs will be better off, and if the House’s pass-through treatment prevails MLP investors will benefit further.

The 2017 Wells Fargo Pipeline and Utility Symposium held last week included the slide below. Energy infrastructure investors need little reminder – 2017 is turning out to be a forgettable year, which has reduced valuations to the levels shown in the chart. Tax loss selling continues, since most investors have substantial investment gains and unloading some energy losers mitigates the tax bill. There’s little other justification for such moves.

People often associate breakthroughs in energy research with electric vehicles (EVs) and use of renewables to provide power. But traditional energy businesses are also the subject of considerable research and development. NET Power, based in Houston, TX, has built a pilot power plant that uses natural gas but captures the resulting CO2. They claim to have built a zero-emission natural gas power plant. Investors have provided $150MM to develop the business. It’s obviously early, but if the technology turns out to be successful on a large scale, given the abundance of natural gas in the U.S., it could be a significant solution to fossil-fuel based carbon emissions. It could even provide a legitimate clean energy alternative to windmills and solar panels. It would represent yet another dimension to the benefits to America of the Shale Revolution. New technology is often exciting, and interesting energy research isn’t limited to wind and solar.

Leave A Comment