It’s very important for gold, bond, and stock market investors to stay focused on the main fundamental price drivers and ignore what may feel exciting but is largely irrelevant to price discovery. Citizen demand from China/India and US central bank policy are the main price drivers for gold.

From 1960 to 1980, US recessions were generally inflationary, and the Fed raised rates during that period. Since then, recessions have carried a deflationary theme, and interest rates have fallen.

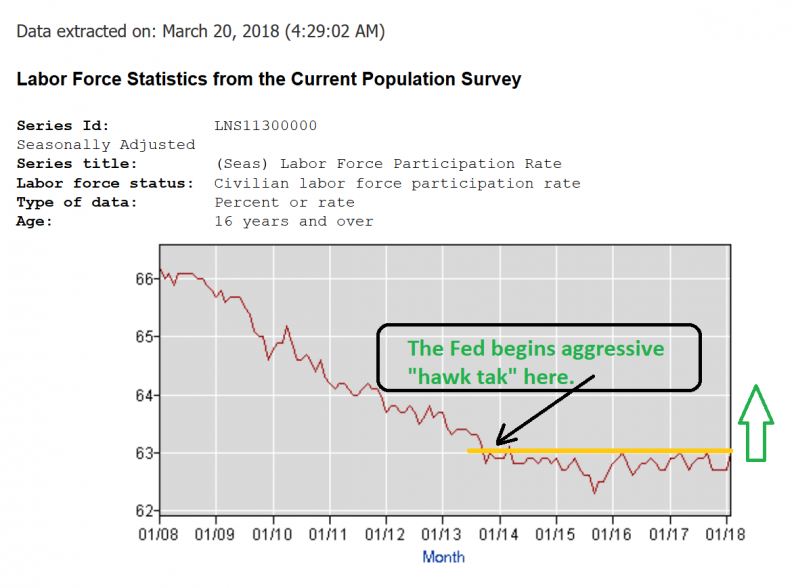

In 2013 I began suggesting that the Fed was going to end its deflationary QE and rate cutting programs. A new era of rate hikes and quantitative tightening would begin, resulting once again in inflationary US recessions.

I’ll dare to suggest that America is now poised to experience its first inflationary recession in almost three decades. Importantly, this is happening while Chinese and Indian citizen demand for gold is beginning to rise after a multi-year lull.

Ben Bernanke created enormous Main Street deflation with his QE and rate cutting policy. He incentivized corporations to engage in massive stock buyback programs while the Fed itself used printed money to buy government bonds. Small bank regulation made it unprofitable to make loans to small business. Main Street deflated, the labor force participation rate collapsed, and financial assets soared.

Double-click to enlarge this important labor force chart.

I’ve described Janet Yellen as the “Great Transitionist”. She tapered QE to zero as I predicted she would and began modest rate hikes. It’s clear that the US labor force participation rate bottomed during her tenure as Fed chair.

Jay “Mr. Hyde” Powell is poised to take her policy to the next level, and launch aggressive QT (quantitative tightening) and rate hikes, and the first of at least eight rate hikes should come tomorrow!

Wage inflation is poised to surge as the participation rate breaks out to the upside. Unfortunately, because Janet moved so slowly with her rate hikes, this wage inflation is going to occur as the US business cycle rolls over, creating an inflationary recession.

Leave A Comment