It was set up for bears to challenge with markets running close to moving average resistance, but in the end, bulls were able to push a break and pressure shorts. Volume wasn’t great, but it’s a start.

The S&P closed above converging moving averages of the 20-day, 50-day and 200-day. There was a ‘buy’ trigger in On-Balance-Volume too. The index also stretched its relative advantage against the Russell 2000.

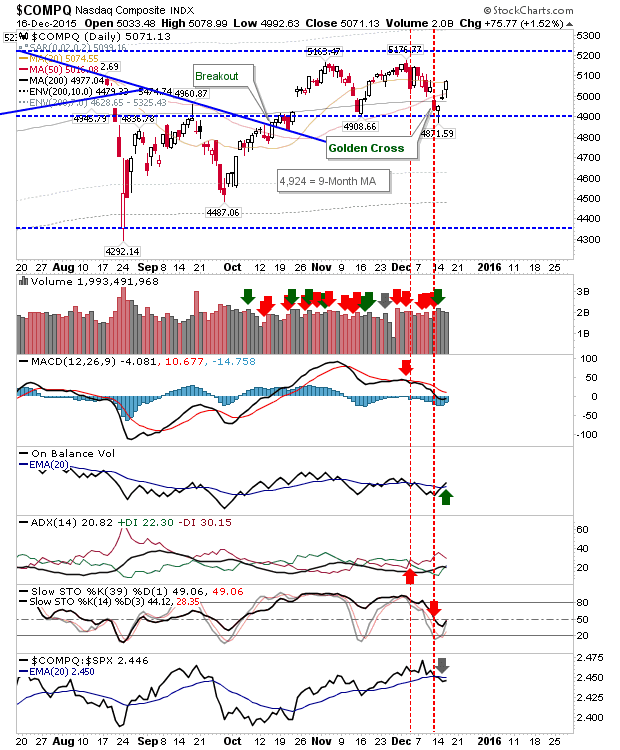

The Nasdaq finished just below its 20-day MA. As with the S&P, On-Balance-Volume generated a ‘buy’ trigger, but the index is losing relative ground against the S&P. If there is a wobble in this rally, the Nasdaq is the index likely to show it first.

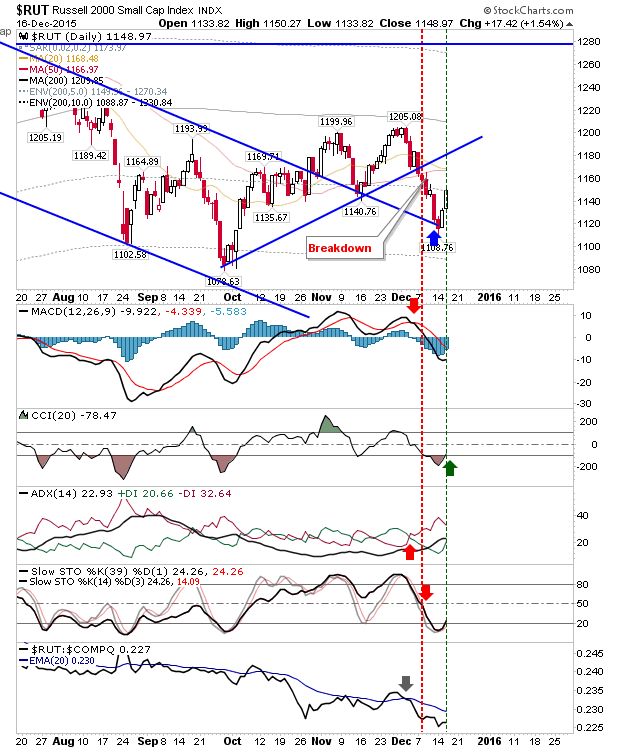

Small Caps were not excluded from the action. While the index is below key moving averages and undperforming relative to others, it was still able to post a gain of 1.5%. While these moving averages haven’t been challenged there is still a chance this index could benefit from further gains before supply becomes a concern. Look for a push to 1,166 over the next couple of days.

The index leading the charge higher is the Nasdaq 100. It’s about to mount a third challenge on the October ‘bull trap’ as the recent trendline break and recovery registered as a ‘bear trap’. Those looking at a play for the long term may find the biggest reward here.

For Thursday, there may be a bit of a Fed hangover, so look for indices to finish near today’s highs to confirm a positive response to the rate hike.

Leave A Comment