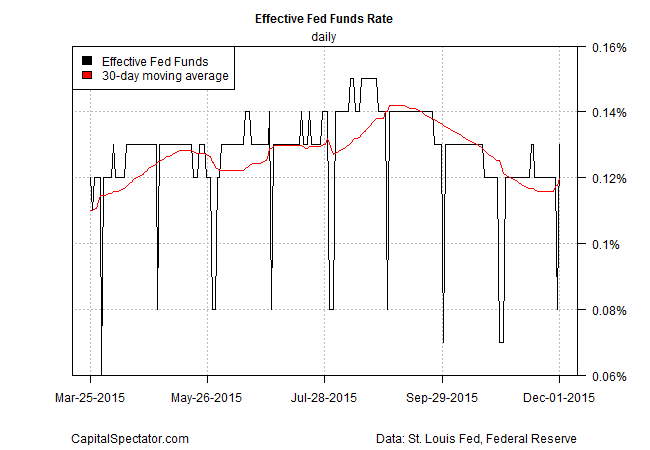

The 30-day moving average of the Effective Fed Funds rate is inching higher for the first time since early September. The revival of the upward bias for this key rate, although slight, is significant in the wake of yesterday’s speech by Fed Chair Janet Yellen, who said that the central bank is moving closer to raising interest rates later this month.

Fed officials have been hinting for months that the first round of monetary tightening in nearly a decade is near. The Treasury market has been pricing in that future, albeit unevenly. Nonetheless, the 2-year maturity, which is widely followed as a harbinger of future policy action, has been trading at or near five-year highs lately. That’s old news. What’s new is the fractional rise in the trend of the Effective Fed Funds rate, which is set by the Fed’s Federal Open Market Committee.

EFF can be volatile in the short run, which is why looking at this rate through a moving average is useful for monitoring the trend. The 30-day average had been trending higher for much of this year before peaking in early September. In the wake of late-summer economic worries, triggered in part by China’s surprise announcement in August that it was devaluing its currency to support growth, the Fed delayed an expected rate hike in September. Three months later, the rate-hike scenario is back on track, with renewed if still-preliminary support in the EFF trend.

For the three days through Dec. 1 (the Fed publishes EFF data with a slight lag) the 30-day average ticked higher. Previously, this average has been consistently flat or declining since early Sep.

Although Yellen didn’t commit to a rate hike at the Fed’s policy meeting that’s scheduled for Dec. 15 and 16, she suggested that a degree of tightening was likely. She was careful to note that “the actual path of monetary policy will depend on how incoming data affect the evolution of the economic outlook.” But short of deeply disappointing numbers in the days ahead, the odds are rising that we’ll see a rate hike in two weeks.

Leave A Comment