Fed Raises Rates In A Hawkish Hike

As expected, the Fed raised interest rates by 25 basis points. In my opinion, the hike was hawkish because the Fed was one vote away from switching its expectations to 4 hikes this year instead of 3. My expectations have been slightly more dovish than the street because I was thinking there would be 2 or 3 hikes this year. Heading into the meeting, the market anticipated 3 or 4 hikes. Therefore, this decision didn’t really catch the market by surprise. It was a modestly hawkish meeting with an improved growth outlook. Investors can look at this positively by saying the Fed is expecting faster growth or negatively by saying the Fed is hiking too fast.

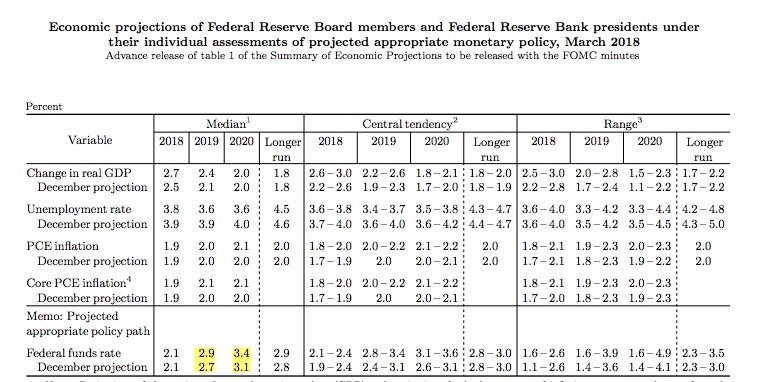

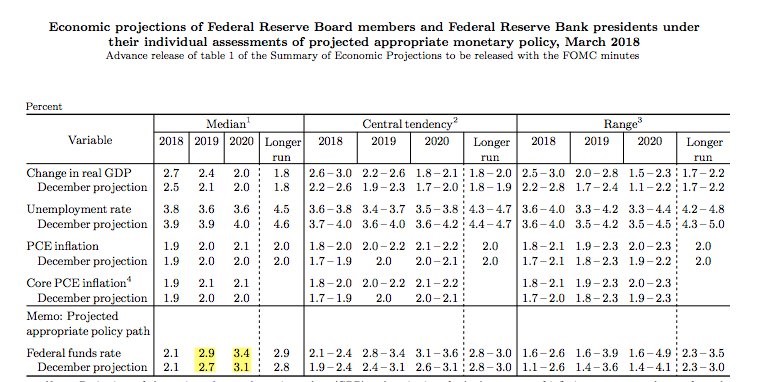

Ultimately, one hike either way isn’t going to be the difference between a recession and strong growth. However, that wasn’t the only change to forward guidance. As you can see from the table below, the Fed increased the projection for the Fed funds rate from 2.7% to 2.9% in 2019 and from 3.1% to 3.4% in 2020. The Fed often is completely at odds with its projections from a few years prior, so don’t take this to mean those rates hikes will certainly happen. I expect the economy to weaken by 2020 meaning there might not be any hikes that year. Powell stated the Fed is watching the yield curve. He didn’t dismiss it. My expectation is that the Fed will start to focus on it more when it comes close to inverting. It’s not close yet; rather, it’s close to being close.

Bullish Powell Pushes Up Median GDP Estimate

The table above also shows the other changes to the Fed’s expectations. As you can see, the projection for 2018 GDP growth moved up from 2.5% to 2.7%. The Fed sees economic momentum but recognizes that the tariffs could stymie growth. Last year, I thought the growth expectations were slightly too low throughout the year. This year, I think the expectations are too high. Once the Q1 GDP growth comes in below the 2.7% estimate, it will be tough to reach 2.7% for the full year. I think the Fed is biased towards looking at its own reports instead of hard data. That’s a mistake because the regional Fed data has been far too optimistic on inflation and the overall economy. The only place where the hard and soft data are meeting is the manufacturing sector.

Leave A Comment