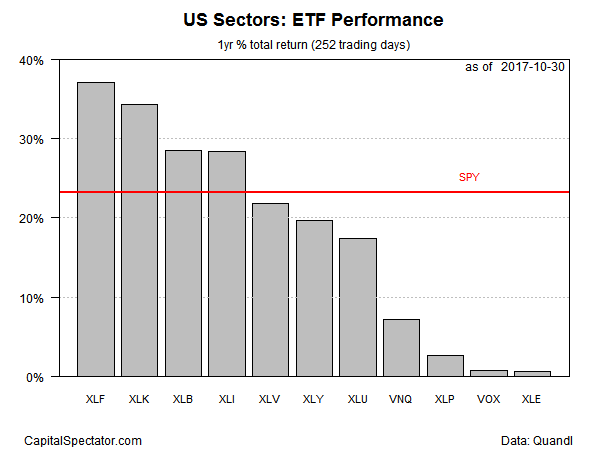

Financial stocks remain the top-performing US sector for the one-year trend, based on a set of ETFs, but tech’s recent surge suggests that a leadership change may be near.

For the moment, Financial Select Sector SPDR (XLF) heads up one-year results, posting a red-hot 37.1% total return through yesterday’s close (Oct. 30). Technology Select Sector SPDR (XLK) is a strong runner-up, rising 34.2% for the past year. But if XLK’s sharp rise in recent days is a sign of things to come, a changing of the guard could be unfolding. Indeed, while tech shares have run dramatically higher this week, the financial sector has sagged lately.

On the flip side, energy shares continue to wallow in last place among US sectors for the one-year change. Energy Select Sector SPDR (XLE) is holding on to a thin 0.7% total return. But the ETF’s weak performance this month suggests that red ink may soon return to this corner of the equity market for the one-year trend.

Meantime, the US equity market generally continues to enjoy a strong trend. The SPDR S&P 500 (SPY) is up a sizzling 23.2% for the trailing one-year period – a performance that’s exceeded by only four of the 11 sector ETFs.

In the next chart below, tech’s accelerating momentum is conspicuous as XLK (gray line near top) closes the gap with financials based on XLF (black line at top).

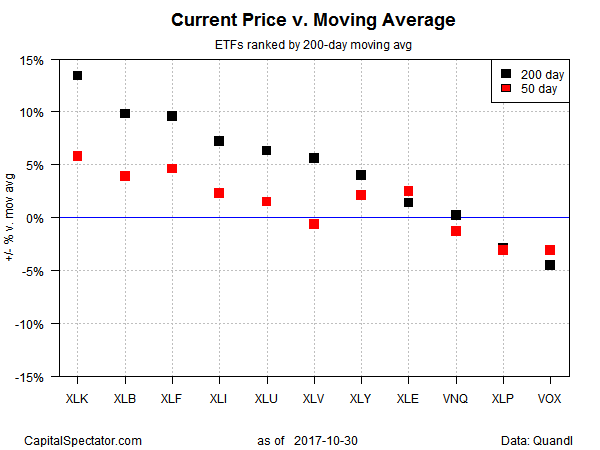

Ranking the sector ETFs by current price relative to 200-day moving average shows that tech has the wind at its back. XLK’s latest close translates into the biggest premium among the sector ETFs based on price relative to 200- and 50-day averages.

Profiling sector results based on one-year Sharpe ratio (SR) shows that tech shares are also in the lead for risk-adjusted performance compared with the other sectors. Note, however, that the broad market posts the highest Sharpe ratio over the rest of the field for the trailing 12-month period – a byproduct of a sizzling return with relatively low day-to-day price volatility. If there’s such a thing as nirvana for the stock market, it probably looks like recent history for the S&P 500.

Leave A Comment