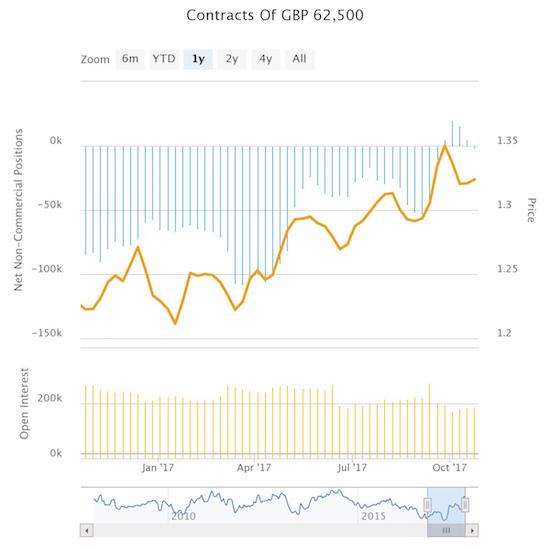

When speculators finally flipped bullish on the British pound (FXB), it looked like the action came right as the currency was making a peak against the U.S. dollar (DXY0). The timing of my observation happened to mark the bottom for GBP/USD, and now speculators have backed down from their nascent pound bullishness. They now hold a very slight net bearish position on pound contracts.

Speculators quickly backed down from their net bullish positioning on the British pound.

Source: Oanda’s CFTC’s Commitments of Traders

Remarkably, a key Brexit price point is holding as resistance for GBP/USD as the pair pivots around its 50-day moving average (DMA).

Source: FreeStockCharts.com

The pressure is building for GBP/USD as the pivoting around its 50DMA is converging upon the intraday low from the first post-Brexit day. Given the uptrends in both the 50 and 200DMAs, odds favor an upside breakout. Supporting strength in the pound is its resurgence against the euro where EUR/GBP just broke through critical support at its 200DMA. This breakdown confirms the downward sloping 50DMA as resistance.

The euro peaked against the pound in late August. Now a 50DMA failure and a 200DMA breakdown confirm the end of upside momentum for EUR/GBP.

Source: FreeStockCharts.com

Overall, the pound is at a critical juncture here. I am still inclined to bias bearish against the British pound, but I have to respect the charts here. Going forward, I will be watching the moves of speculators for potential (contrary?) clues. Ultimately, the Bank of England’s (BoE) on-going chatter about what it MIGHT do will likely rule the day (another meeting and interest rate decision coming up this Thursday) even as trading dives into a week heavy with economic data and a U.S. Federal Reserve decision on monetary policy.

A key quote from Bloomberg in a pre-BoE article:

“So far, though, pay is not accelerating. More important, the economic outlook is getting worse: Investment and business confidence may come under increasing pressure as the Brexit nightmare unfolds. Changes in interest rates take time to affect the economy, so by the time any increase starts making a difference, there might be more slack, not less. That would force the bank to reverse itself — making monetary policy a source of added instability.

Granted, consumer debt is rising fast and could become a threat to financial stability in its own right. However, this problem can be addressed without changing interest rates. The bank has already used so-called macro-prudential policies for this purpose, and should do more.”

Leave A Comment