The Euro is doing nothing more than meandering around versus the rest of its major counterparts, seemingly oblivious to developments at home as (admittedly) more interesting developments take place abroad: the Federal Reserve’s cheeky attempt at normalizing policy; Chinese/emerging market growth slowing down rapidly; and geopolitical tensions between military superpowers ratcheting higher across all corners of the globe. All of it makes for a rather distracting trading environment, and less ‘flashy’ developments can easily be overlooked.

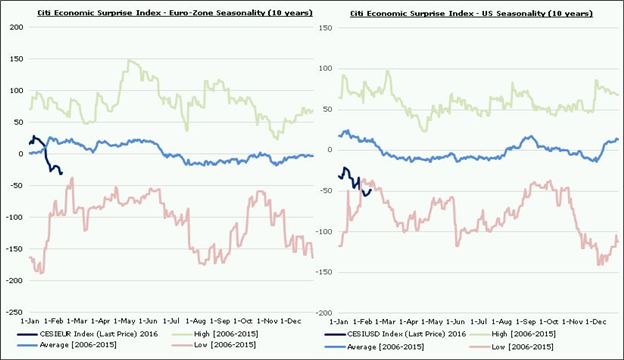

A look under the surface shows that the Euro-Zone is starting to face more difficulties of its own as the calendar approaches the halfway mark of Q1’16. Much like its American counterpart across the pond, the Euro-Zone economy is off to a disappointing start to 2016. Per the Citi Economic Surprise Index, US data momentum is off to its worst start over the past 10 years, while Euro-Zone data momentum isn’t that much less disappointing:

Chart 1: Euro-Zone and US Citi Economic Surprise Indexes – 10 year Seasonality

The narrative early in the year, one that continued over from December (and was very much the case at the European Central Bank’s last policy meeting of the year), was that Euro-Zone data ex-inflation was doing well enough to keep the ECB on the sideline. That’s just not the case anymore after several weeks of softer economic data.

From the Euro’s perspective, it’s important to consider why the ECB cut its deposit rate on December 3 – and did not make changes above what the markets had already priced in for the QE program. Financial conditions were not considered a headwind with the EUR/USD trading nearly -5% below the ECB’s EUR/USD NEER (nominal effective exchange rate, the technical assumption underpinning the ECB’s growth and inflation forecasts) at the time of the December meeting. Between data ex-inflation being firmer and the exchange rate so low relative to its technical assumption, the ECB deemed it wasn’t time to use its “bazooka,” and the Euro screamed higher.

Leave A Comment