Global Equities were given a boost the past few days, which has been bullish for the GJ pair. Japanese data has been solid the past week, and its major trading partner in China has posted strong data for the week. Whereas, US data has largely been meeting expectations.

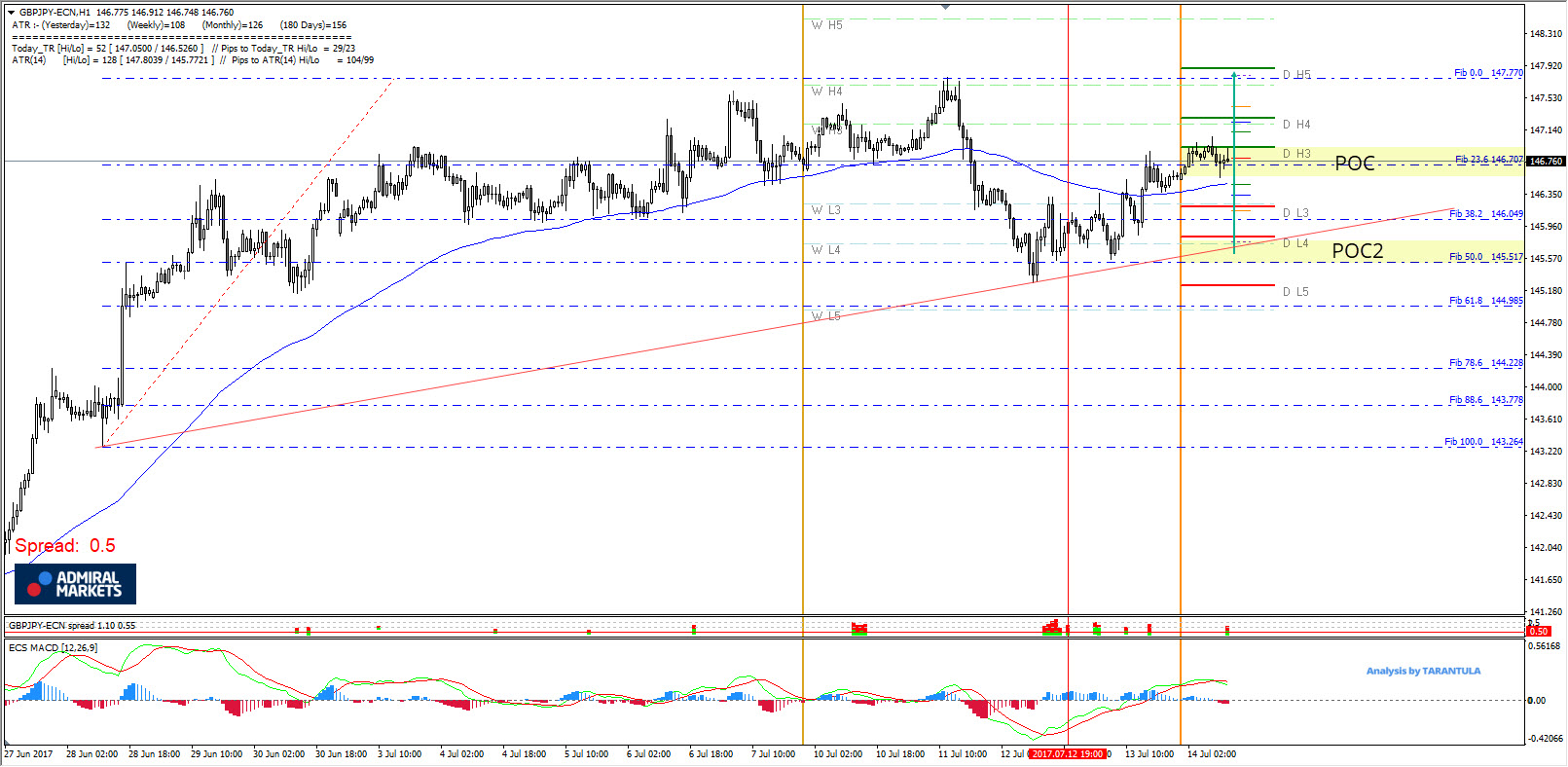

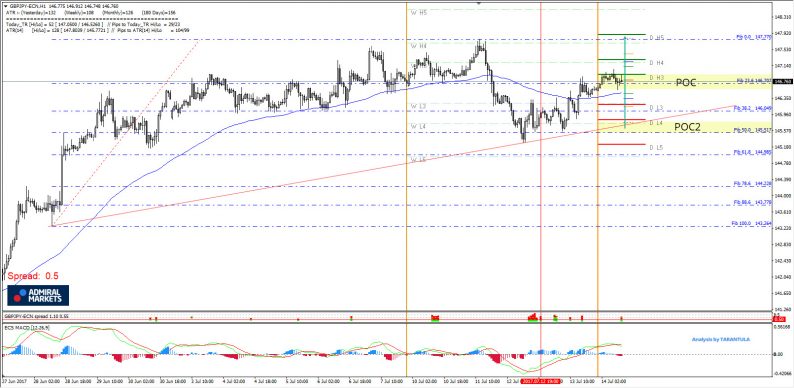

At this point, we can spot 2 POC zones where the price could reject as the pair is making a technical zig-zag pattern. POC1 (D H3, 23.6, EMA89, ATR pivot) comes within the 146.65-80 zone. POC1 rejection should be a sign of a strong trend due to technical confluence it makes within the POC itself. If it rejects from this zone the pair should target 147.80 where the doors for 148.50 might be open next week.

Deeper retracement targets 145.55-75 zone (D L4, trend line, ATR low, W L4) and rejection from this zone targets 146.80 and 147.80 if the pair makes 4h close above the level.

W L3 – Weekly Camarilla Pivot (Weekly Interim Support)

W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

POC – Point Of Confluence (The zone where we expect the price to react aka entry zone).

Leave A Comment