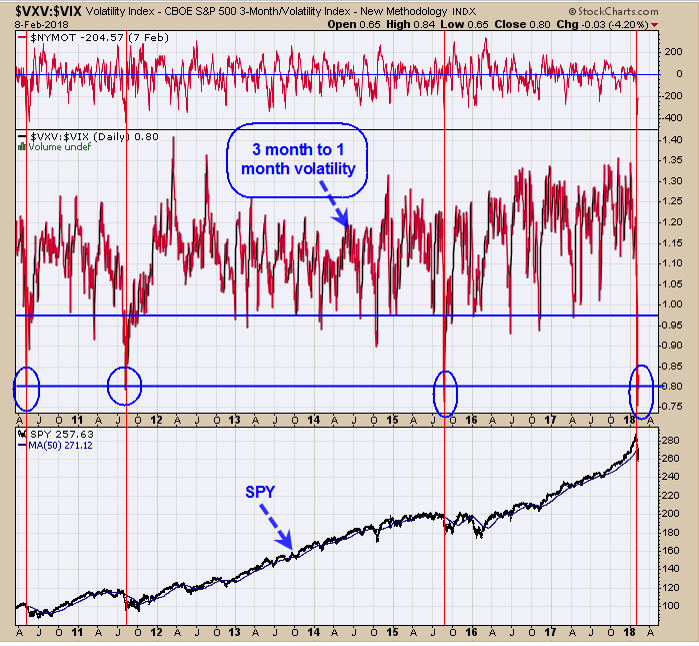

On the chart above you can see the movements of one month – three moth volatility (VIX/VXV). When this ratio reaches .80 or lower the market has been near an intermediate term low. This ratio suggests that an extended decline is not the beginning here but that the decline is near an end. Long SPX on 2/8/18 at 2581.00.

If the market falls back down and tests yesterday’s low on much lighter volume, a bullish setup could unfold, today, the SPY decline, tested Tuesday’s low on much lighter volume, after that a setup of the conditions formed a new low.

Yesterday the TRIN closed at 1.43 and the Ticks closed at -387 and today the TRIN closed at 1.21 and the Ticks at -418. Both are in a bullish combination which suggests that the market is near a low. Not sure if today will be the low but the statistics suggests a low is near by. Also, Option expiration week is next week which usually has a bullish bias and should bring us a week in the up.

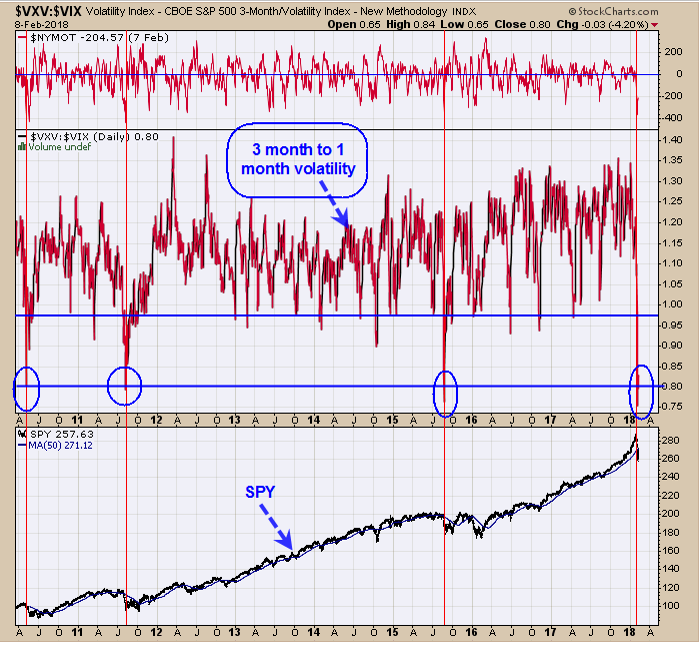

On the above chart (dating back near 3 years) you can look at the Fibonacci levels for GDX; GDX/GLD ratio; Advance/Decline Cumulative and Up Down Volume Cumulative.

When a market retraces 50% or less of its previous rally, it is said that the market is in a relative strong position. When a market retraces 61.8% or greater of its previous rally than the market is in a weak position. The top window is GDX which is holding near the 50% retracement level and in general that is a bullish sign. The next window down is the GDX/GLD ratio which in general is also holding near the 50% retracement level and in general that is also a bullish sign. The next window down is the Advance/Decline Cumulative, which is showing a bullish development holding above its 38.2% retracement level suggesting internal strength for GDX. The next window down is the Up/Down Volume cumulative which is holding near the 38.2% level and also showing strength.

Leave A Comment