The Short-Term Trend

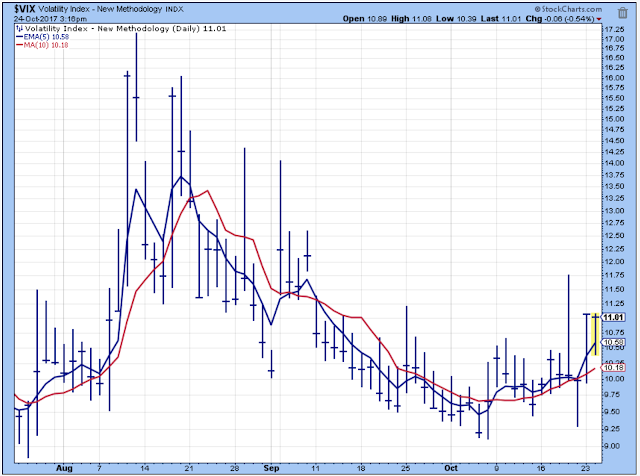

The short-term uptrend refuses to top out despite the signs of short-term stress such as this chart below of the VIX which is pointing higher.

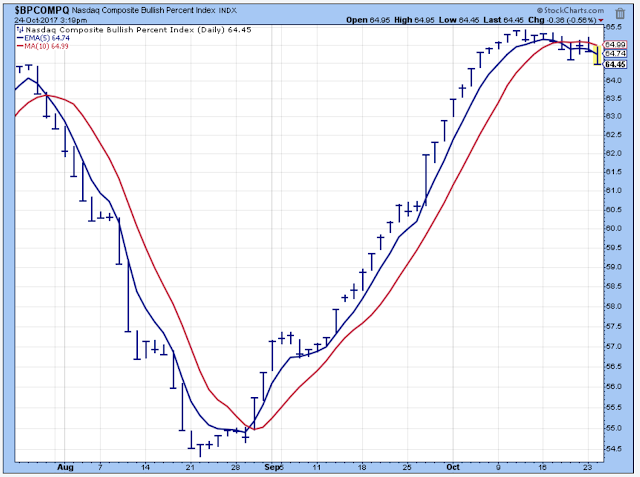

The Nasdaq bullish percent has rolled over, although the NYSE bullish percent is still ticking up.

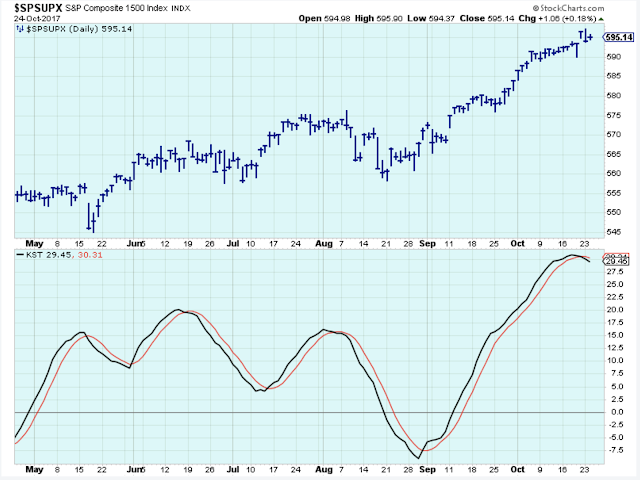

Stock prices remain in an uptrend, but momentum looks like it is with the bears in the short-term based on this KST indicator shown below.

The unstoppable leader of this market is shown below. The general market isn’t going lower as long as this index is hitting new highs.

Rates

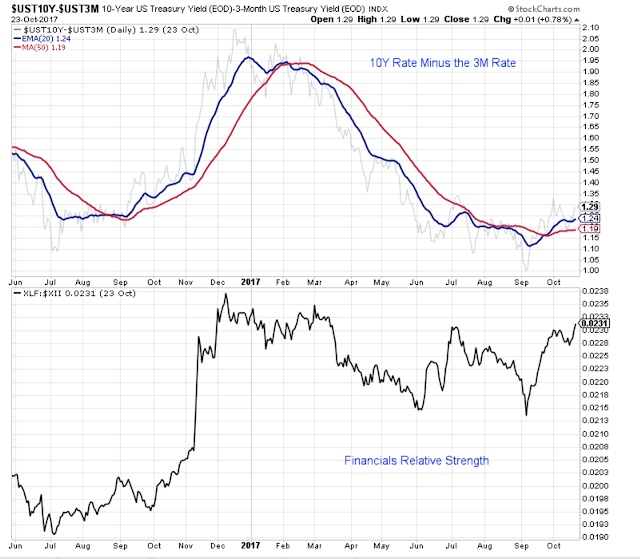

In the very short-term, based on this chart, rates appear headed higher, and that favors the financials such as XLF and KRE. However, like a lot of people, I am a skeptic about higher rates longer-term because inflation remains so low.

This looks like a set up for a break out higher, but I need to see it tick up above resistance before I believe.

The Short-Term Leader List

The strongest ETFs are blue, the additional leaders are green and the weakest are red. The S&P500 is the benchmark. Disclaimer: This list is not a recommendation to buy or sell.

Outlook

The ECRI index was pointing to weak economic growth in the months ahead, but the index has now bottomed out and is pointing higher.

The long-term outlook is improving.

The medium-term trend is up. The best period for buying is past.

The short-term trend is up. Still looking for a short-term top.

Leave A Comment