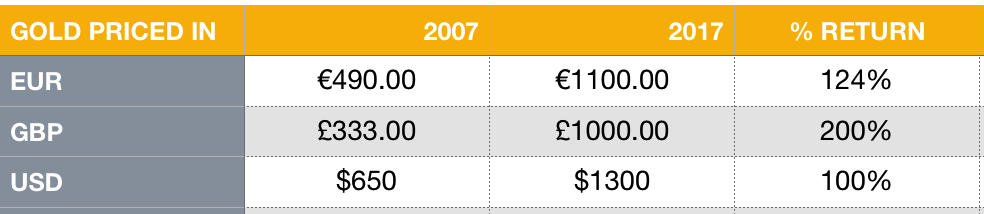

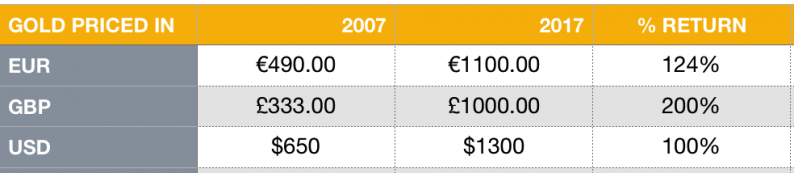

Gold prices from August 9th 2007 to August 9th 2017

It has been ten years since the global financial crisis began to take hold. At the time few would have known that BNP Paribas’ decision to freeze three hedge funds was the signal for the deepest recession in living memory and a near-collapse of the financial system.

As the French bank blamed a “complete evaporation of liquidity” on its decision the ECB flooded its the market with billions of euros of emergency cash as it worked to prevent a seizure in the financial system.

No-one could have known how much the financial and investment landscape was set to change.

In the proceeding decade we have seen unprecedented intervention by central banks which in turn has created a punishing financial landscape for savers and investors.

For those who were unfortunate to experience bank bailouts first hand or a collapse in a housing market, an instant lesson was learnt about the importance of protecting your savings.

That would have been a savvy lesson to learn. Any investors feeling the ripples of the financial crisis and looking to protect their wealth may well have looked to gold as an option. By adding gold to their portfolio they would currently be looking at some extremely healthy returns.

For those who were slower on the uptake of portfolio protection, they still would have benefited from gold’s decade climb and its performance alongside other major asset classes.

Gold’s decade long climb

Gold continues to be dismissed by the mainstream as an important asset-class for investors. However the decade long-climb for the precious metal is example enough of it’s strong performance against a backdrop of financial and political turmoil.

Leave A Comment