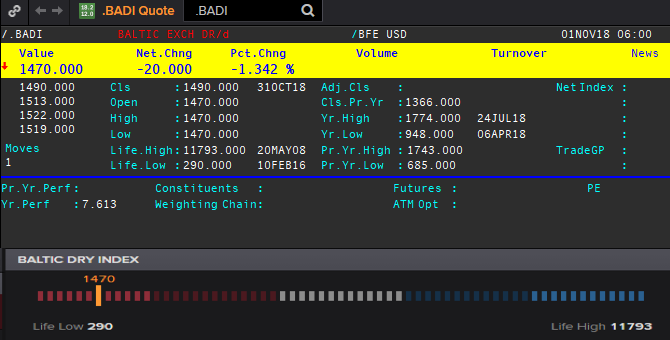

The Baltic Dry Index, a composite of the Capesize, Panamax and Supramax Timecharter Averages, hit a one-month low this week, pulled down by weaker demand for Capesize vessels. The shipping index is widely viewed as a proxy for dry bulk shipping stocks as well as a general shipping market barometer.

Baltic Dry Index quote (data via Reuters Eikon)

In August, we first reported that freight data via Goldman identified global trade momentum was slowing since 4Q17, and that July readings suggested an alarming continuation, and in some cases acceleration, of this trend.

The deceleration in shipping rates has closely tracked a tightening in global financial conditions, particularly evident in EM data, which in turn has largely been a manifestation of the ongoing escalation in trade tensions between the US and China.

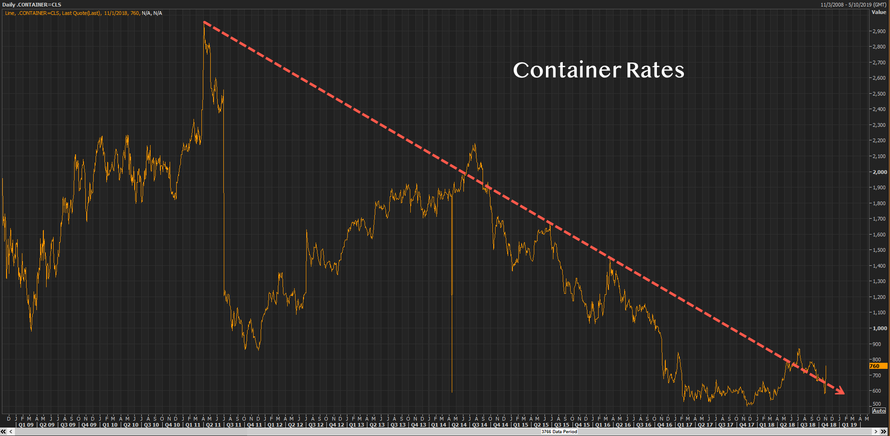

Now, fresh evidence from Reuters shows the cost of chartering commercial ships has collapsed even further. More specific, rates for container ships have sunk 24% from a multi-year peak while raw material vessel rates have fallen 10% from a five-year high, adding to the mounting evidence that slowing global trade could soon usher in a worldwide recession around 2020.

Container Rates Collapse

At the heart of the supply chain, dry-bulk vessels transport raw materials like grains, coal, ore, and cement while container ships complete the cycle by carrying finished goods from factories to consumers.

Around April, dry-bulk and container rates rocketed to multi-year highs as manufacturers pulled forward consumption to get ahead of the tariffs. The rates peaked in August and started a declined that found a bottom in September/October.

Baltic Exchange Indices Performance

“The flattening out of the Baltic dry index, corroborated by the container index as well, points to a slowing down of the global economy for sure,” Ashok Sharma, managing director of shipbroker BRS Baxi in Singapore, told Reuters.

Leave A Comment