It’s difficult at present to understand why gold is failing to respond to its traditional drivers, particularly as these are not in short supply. First geopolitical events ranging from Donald Trump’s tariffs to the Salisbury poisonings where the Russian state has been alleged to have used chemical weapons against two of its citizens. And of course, we must not forget inflation, which if central banks are to be believed is lurking and waiting to pounce, hence the rationale behind the Fed’s proposed 4 to 6 interest rate hikes this coming year. And finally, the USD whose weakness has failed to inspire the precious metal in any meaningful way.

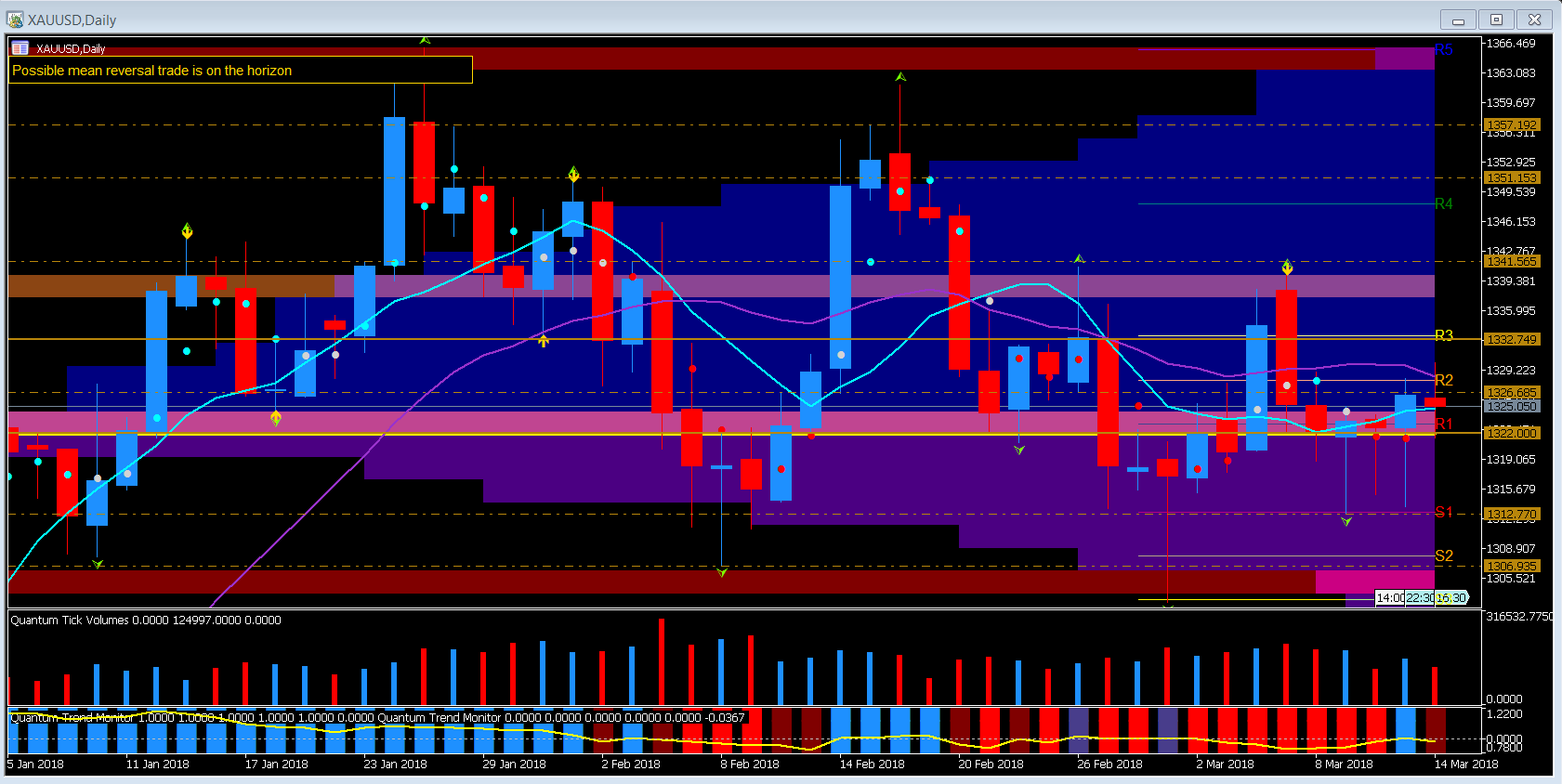

And from a technical perspective, the daily chart for gold too is far from inspiring as the precious metal continues to swing and trade around the volume point of control at the $1321 per dollar price point as traders and investors fail to provide any strong sentiment in either direction.

However, there are a number of technical signals which do bear closer examination, and which may help in both the short and longer term for gold.

First on a positive note gold has built a solid platform of support in the $1300 to $1312 price region, with yesterday’s candle managing to close above the VPOC on reasonable volume. This mirrored last Friday’s candle which saw a similar price action and volume profile. Furthermore, the $1312 price level also coincides with the S1 of our Camarilla levels so adding further weight to these two bullish candles.

Yesterday’s price action also moved gold through the first Camarilla resistance level and onto the second at $1328 from where it has subsequently pulled back in today’s trading. And it is the $1328 price point that gold must now clear if it is to continue higher. The VPOC and R1 level at $1321 should provide a comfortable cushion, but any failure here on good volume would see the metal back down to test $1312 once again.

Leave A Comment