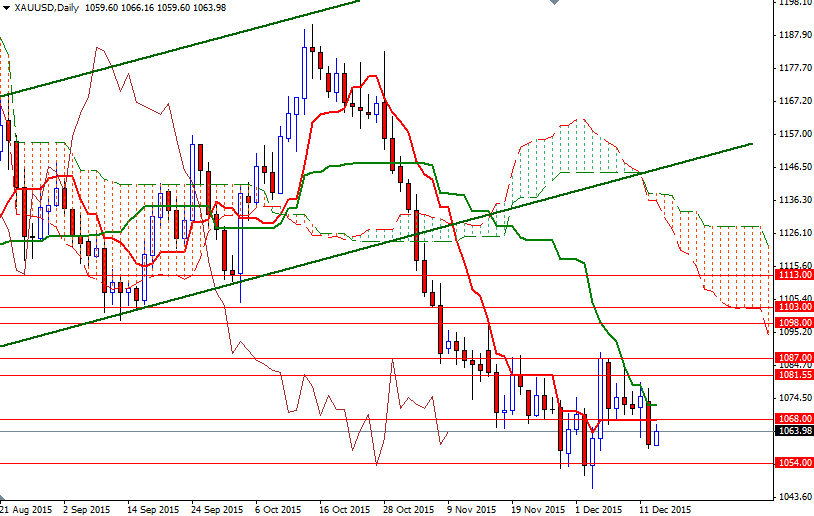

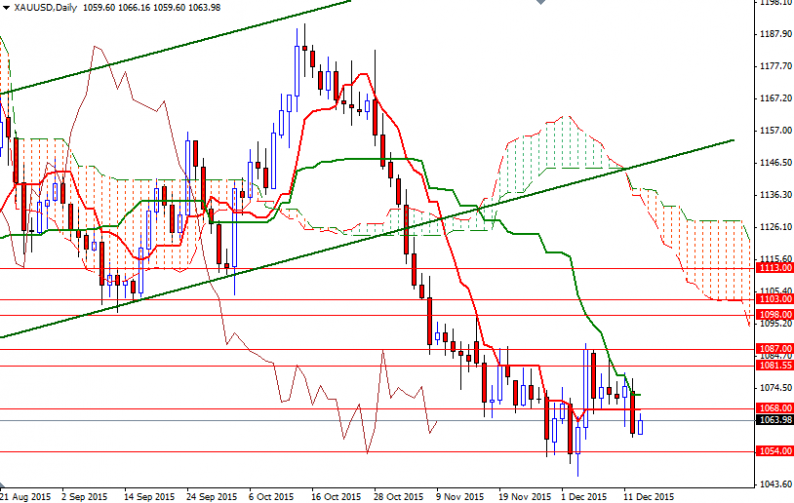

The market started the week on the back foot, breaking below the 1066/4 area, and tested the support around the $1058 level. Gold prices fell $13.41 an ounce yesterday as market players positioned for a looming Fed rate hike. A rebound in stock markets also weighed on the precious metal. The XAU/USD pair is trading at $1063.98, higher than the opening price of $1059.60.

The drop in gold, despite the weakness in the dollar and volatility in global equities, demonstrates that investors have limited interest in gold. The XAU/USD pair continues to suffer from the long-term bearish outlook which has been overwhelming the market since the 1532 support was broken. However, prices have been trapped in a relatively narrow range of around $45 for the past 5 weeks.

The first hurdle gold needs to jump is located in the 1068/6 region. If the bulls manage to climb and hold prices above the bottom of the 4-hourly Ichimoku cloud, they may find a new chance to test the next resistance at 1075.50. The bulls will have to overcome this barrier in order to set sail for the 1081.55 level. On the other hand, if XAU/USD persists in remaining below the 4-hourly Ichimoku cloud, we may see the market heading back to the 1058 level. A successful break below 1058 would suggest that the bears are going to target 1054 next.

Leave A Comment