For gold investors, some days are more awesome than others, and I’ll boldly suggest that today is one of those days. Here’s why:

Inflation is no longer near. It’s here.

Measured by “stuff used”, China is the world’s largest economy.

Producer prices there have surged steadily since the start of 2016, and the index has now crossed above the key 100 marker.

China is poised to become the world’s biggest exporter of a product that most analysts have forgotten about; inflation!

Also, gold stocks, which I call the canary in the inflationary coal mine, may be poised to start a fresh uptrend.

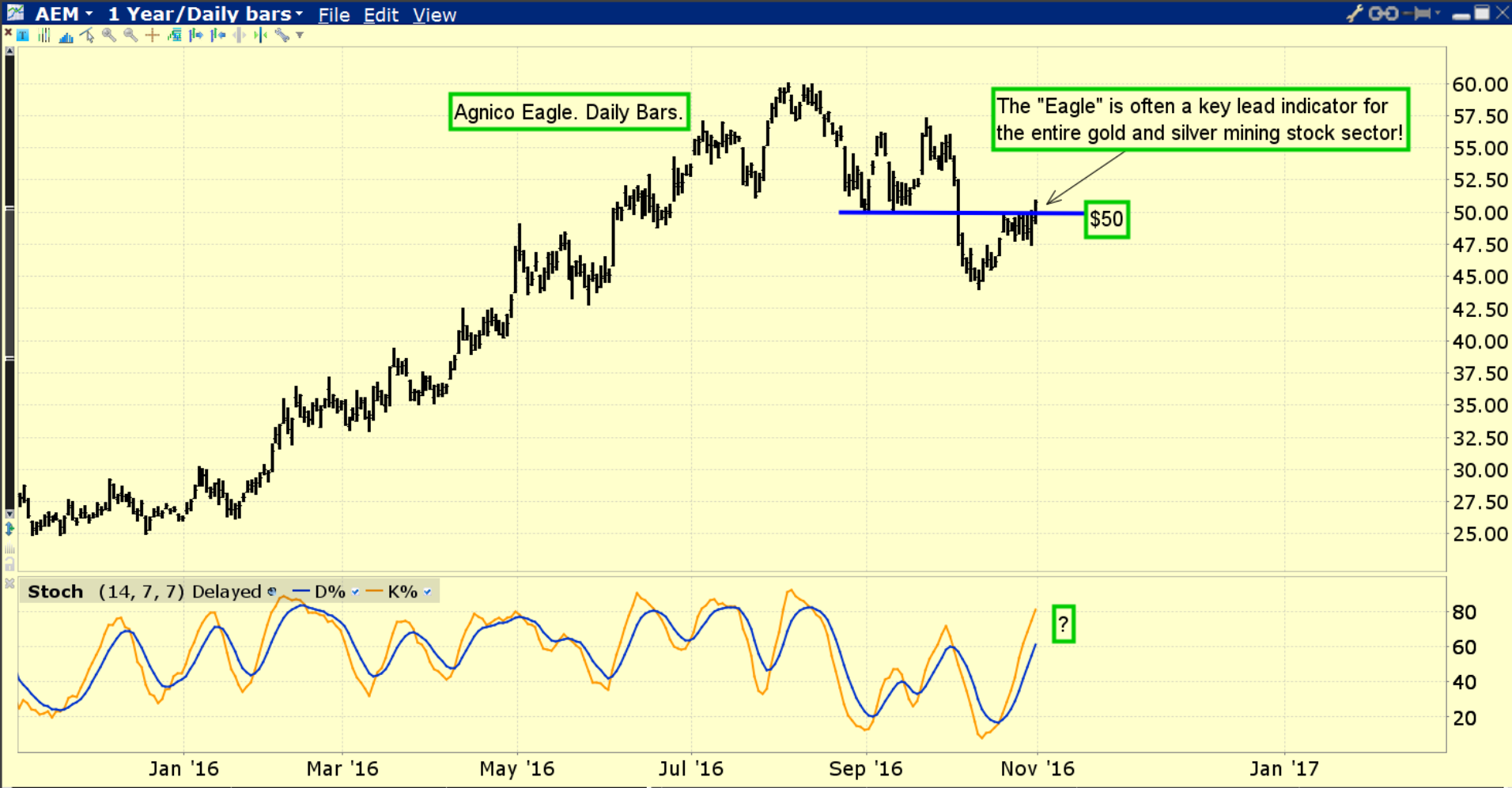

Double-click to enlarge this Agnico Eagle chart.

The “Eagle” just staged a one day close above the key round number of $50.

This great company is one of my key lead indicators for the entire precious metals sector, and a three day close above $50 could indicate that a new intermediate term uptrend is underway.

Agnico Eagle is sometimes able to cover its entire gold mining costs just from its silver production, and it’s an important component in the GDX ETF.

Also, Friday is US jobs report day, and a post report rally could see Agnico Eagle stage a weekly close above that important $50 mark.

To view some longer term good news.

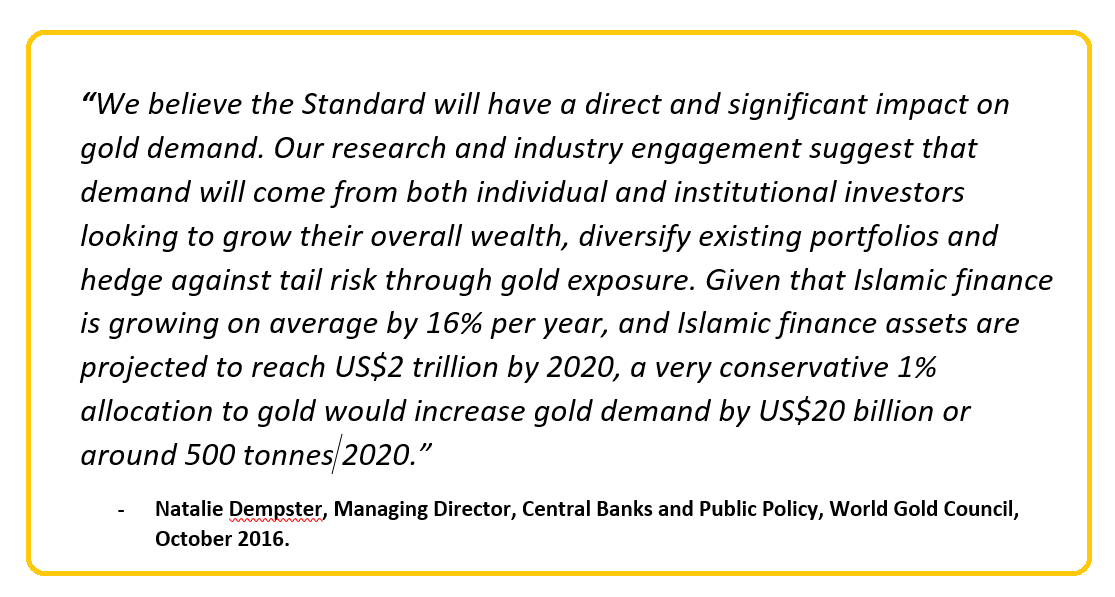

Top Islamic financial organizations have teamed up with the World Gold Council to launch the new Shari’ah Standard. It will be launched December 6, just two days after the upcoming Italian referendum.

The new “Standard” will allow Muslims to invest in gold in accordance with shariah law, and the World Gold Council predicts the Standard will add a whopping 500 tons to global demand, over just the next four years!

It’s going to become increasingly difficult for mining companies to grow their production enough to keep up with this kind of demand growth.

It’s becoming very clear that investors who are looking for gold price discovery “action” won’t be bored in the last few months of this year. Chinese New Year buying also begins in another month or so, and the US election is now only about a week away.

Leave A Comment