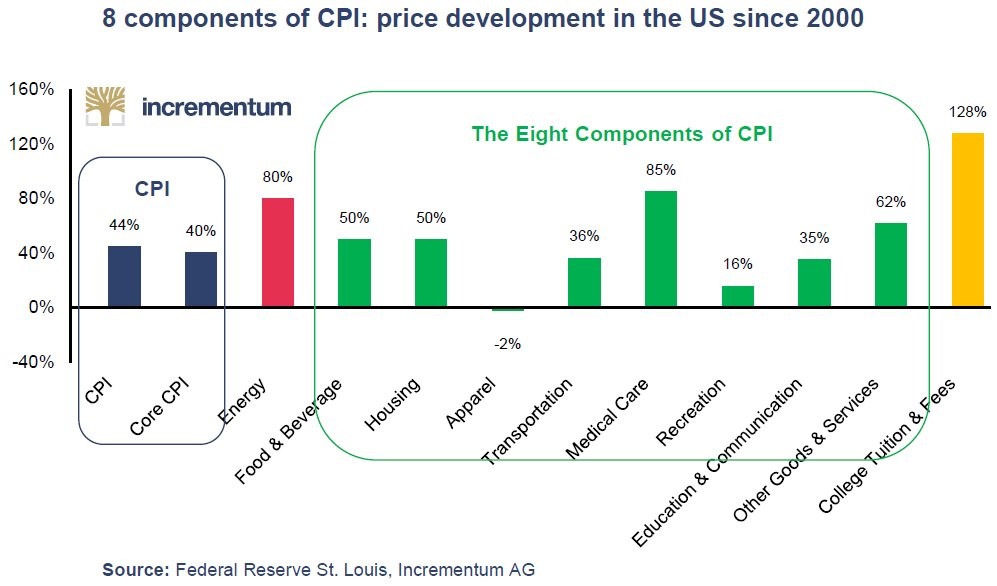

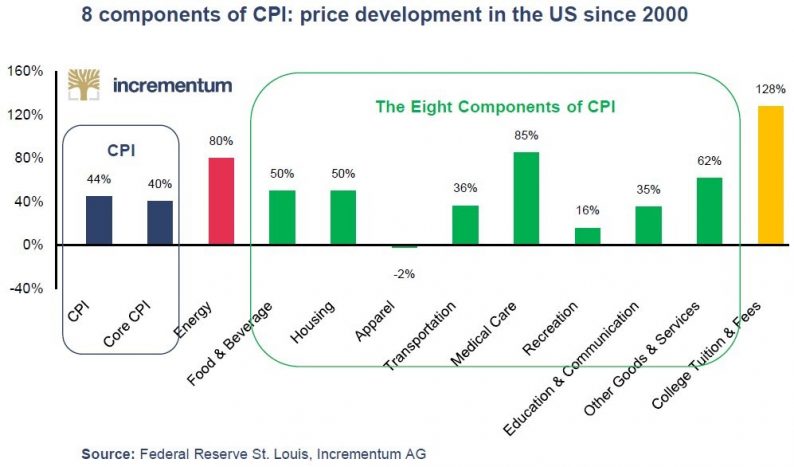

We’ve had some readers question the Fed’s use of CPI as a measurement of price inflation. The chart below might satiate them as it shows the eight components of CPI.

17 Year Inflation Breakdown

Medical costs have pushed inflation higher. Keep in mind, this is over a 17 year period. We’re not ignoring the recent acceleration in medical cost inflation. The media always draws attention to the increase in energy prices, medical costs, and college tuition because they are big stories. However, there aren’t as many reports on the segments which have seen below average price inflation such as recreation, apparel, education & communication, and transportation. Therefore, it seems like price inflation is higher than it is on everything. While this certainly doesn’t make it easier that there is price inflation, every sector needs to be reviewed individually.

As we’ve mentioned in a previous article, college costs are their worst in terms of price inflation. A decline in costs of tuition or a bursting of the student loan bubble would alleviate low economic growth. Now default rates are high, prices are high, and because so many people have a degree, it doesn’t differentiate workers at all. The price doesn’t match the product’s value.

Back To The Basics On Gold

Surprisingly, one of the most contentious issues about gold and inflation isn’t where they are headed; it’s their relationship. Traditionally, it’s thought that precious metals are inflation resilient. It’s not enough to say they are inflation hedges because they maintained their value over time. We’re not disputing gold’s ability to maintain its value in the future; we’re saying investors need more due diligence done before adding it to their portfolios. As we’ve detailed previously in Is Gold A Good Investment?, the relationship between gold and inflation in the short-term is complicated, because real interest rates, not nominal, are important to consider.

Leave A Comment