Gold prices settled at $1273.21 an ounce on Friday, suffering a loss of $11.80 on the week, as the U.S. dollar’s strength against other currencies weighed on the market. The XAU/USD fell as low as $1256.83 earlier in the week but the weakness in global equity markets helped recoup some of the earlier losses. Friday’s data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 264898 contracts, from 271648 a week earlier.

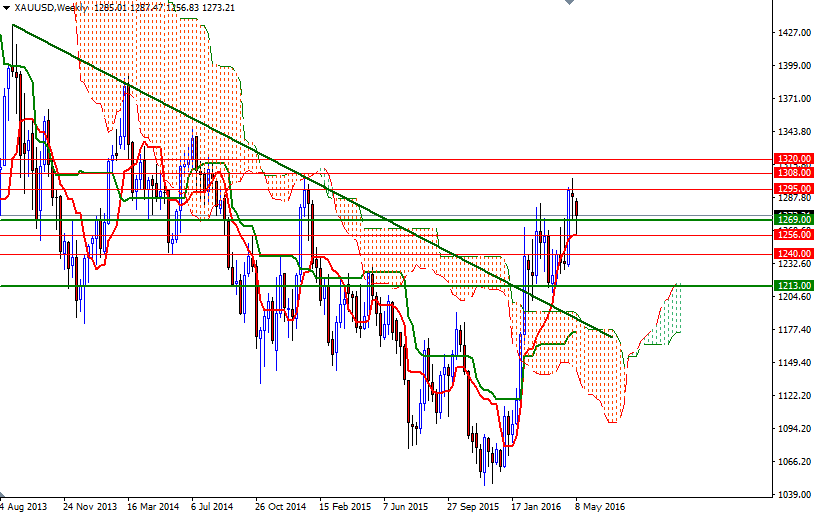

Gold has rallied 19.8% this year, mainly driven by the continued unease surrounding the global markets and expectations of a delayed interest rate hike from the Federal Reserve. If we begin to see a consistent improvement in the U.S. economy which made a slow start to 2016, the prospect of a rate increase in June could put some extra pressure and cap prices. From a technical perspective, there are two things that I pay attention at the moment. First of all the market is trading above the Ichimoku clouds on the weekly and daily time frames, plus the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on both time frames. Secondly, despite a positive medium-term outlook, the 4-hourly chart points to a neutral bias.

A sustained break above the 1280 level which happens to be the daily Tenkan-sen would set the XAU/USD pair up for another test of the 1290/87 area. Penetrating this barrier could foreshadow a move towards the 1297/5 region. If this resistance is broken, then the 1308/3 area could be the next port of call. If XAU/USD fails to overcome the 4-hourly cloud, keep an eye on the 1263 and 1258/6 supports. As I mentioned a week ago, the bears have to capture these strategic camps so that they can find a chance to test 1251 and 1246. Closing below 1246 would suggest that the market will approach the top of the daily cloud at 1240.

Leave A Comment