Most famous fund failures have leverage at their core. That’s the true culprit for disaster — not the actual trade ideas. Bad position sizing kills.

Long Term Capital Management’s strategy involved scanning the world for bond spreads that diverged from historical values — something known as convergence trading. When spreads diverged from their means, LTCM would buy the cheap and sell the expensive bond. Then wait for prices to revert back to their “theoretical efficient” market price and make a small profit.

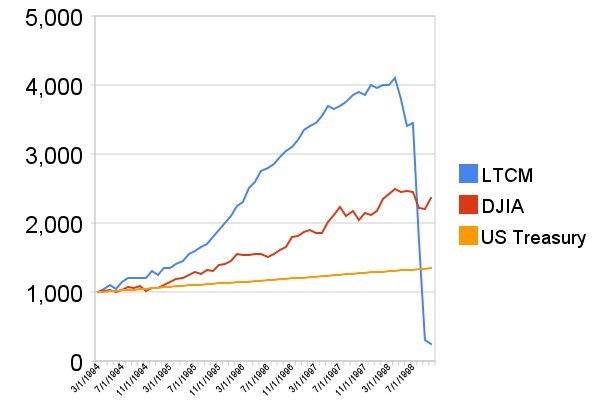

But LTCM wasn’t satisfied with the tiny profits on the spread. They were “Masters of the Universe” and wanted to put up bigly numbers that smoked the S&P. So they took this simple strategy and leveraged up to high heaven.

Before LTCM was incinerated they had a portfolio market value of $129 billion. Of which, $125 billion was borrowed money. That’s a leverage ratio of 32:1.

Once old lady volatility hit the market, those bond spreads that LTCM had leveraged to infinity betting that they would quickly converge just like all previous times… kept diverging… and diverging. Until eventually LTCM was forced into liquidation.

Leverage and crowding caused the forced unwind of the trade. Not the strategy of buying cheap bonds and selling expensive bonds. LTCM had a good strategy that they ruined with excessive leverage.

The exact same leverage issue happened to Victor Niederhoffer in 1997.

After suffering from a huge loss on Thai stocks during the Thai Baht crisis, Niederhoffer turned to aggressive S&P 500 put writing in order to “make back” his losses.

Over the summer of 1997 he shorted out-of-the-money November 830 puts for prices between $4 and $6.

By October these puts were trading for just $0.60 and Niederhoffer had a large gain. But the Asian Contagion spread and eventually hit the S&P.

On Thursday October 23rd, 1997 the puts rose to $1.20. On Friday the S&P dropped further but closed well above Niederhoffer’s option strike. Niederhoffer still wasn’t worried — his puts were trading for $2.40.

Leave A Comment