I imagine that many of you will be familiar with the biblical quotation, “Money is the root of all evil”. Yes? Good. Well, not good actually, because it is a misquotation. The real quote from the Bible reads as follows:

“The love of money is the root of all evil”

Look it up if you don’t believe me. New Testament, 1st Timothy, chapter 6, verse 10. If we compare the original quote with the popular misquotation, it changes the entire meaning of the sentence. It is not money in itself that is evil, rather it is people’s attitude towards it which creates the problem.

Look it up if you don’t believe me. New Testament, 1st Timothy, chapter 6, verse 10. If we compare the original quote with the popular misquotation, it changes the entire meaning of the sentence. It is not money in itself that is evil, rather it is people’s attitude towards it which creates the problem.

And so it is in negotiation – at least in negotiations from 7 o’clock onwards on the Clockface. A preoccupation, or obsession, with money is a significant obstacle for the negotiator who is seeking to collaborate, create mutual value and generate a Win-Win outcome. Because my money is worth exactly the same as your money. There is no value differential, no low-cost, high-value opportunity to exploit. If I make a concession of $10 to you, it costs me $10 and represents a value of $10 to you. Value Distribution, not Value Creation. In fact, let me go a bit further:

“Money is not valuable”

That sound you can hear in the background is all the financial directors in the world falling off their chairs and screaming for me to be burnt at the stake as a heretic. Don’t panic, go and help them up, and read on. Later in this article I will give you a formula which can be used to calculate value and which should placate them. Let me explain: money is not valuable in itself, it is simply a convenient, universal common denominator that we use as a yardstick to measure Value.

Furthermore value is defined by an individual’s or an organisation’s perception of what they can achieve as a result of an agreement. If you get a good bonus this year, that in itself is not valuable, it only has value if you can take the family on the holiday of a lifetime or buy that sports car you have always wanted.

If two negotiators are simply trading money, then the scope for Value Creation is limited or even non-existent. Moreover, if both parties can see and measure how much money the other is making, one quickly becomes envious of the other’s share of the deal, they start to get competitive and the negotiation can become very fractious as each party seeks to “win” – and it quickly becomes clear that the only way to do this is at the expense of the other party. Win-Lose, not Win-Win.

Value can be expressed in an algebraic form:

The Value Formula: Value = (Benefit – Cost). Or V=(B – C)

In the $10 transaction described above B = $10 and C = $10. So, in this case V = (B – C) = 0. All we have done is moved money from one place to another, generating no value.

Creating value is not as easy as it sounds; as negotiators we need to think about the variables we trade in order to create the circumstances which will allow an outcome that leaves both parties better off.

If simple monetary variables are ineffective ways of generating value, we need to identify Alternative Currencies – variables which represent a greater Benefit to one party than they represent a Cost to the other. And frequently, we may have to educate our counterparties before they are prepared to engage in trades of this nature.

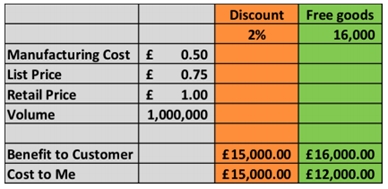

Let’s take an example: you sell 1 million cans of beans to a supermarket per year. Your can of beans has a typical retail price of £1.00, you sell the can of beans for £0.75 and it costs you £0.50 to manufacture. Your customer has come to you and demanded a 2% volume discount in return for maintaining your current terms. That represents £15,000 which he wants you to take out of your pocket and put into his.

The calculation for this is as follows:

But let’s say you start thinking about Alternative Currencies and you decide to offer your customer 16,000 products free of charge instead of a straight discount. Your customer can sell these for £16,000 at 100% profit, clearly a bigger benefit than the 2% discount. But significantly, the cost to you (the £0.50 manufacturing cost plus the £0.25 profit you would have made on the sale of 16,000 cans) is substantially lower at £12,000. That is because we are now trading in a currency other than pure money which represents a different value to each negotiator.

But let’s say you start thinking about Alternative Currencies and you decide to offer your customer 16,000 products free of charge instead of a straight discount. Your customer can sell these for £16,000 at 100% profit, clearly a bigger benefit than the 2% discount. But significantly, the cost to you (the £0.50 manufacturing cost plus the £0.25 profit you would have made on the sale of 16,000 cans) is substantially lower at £12,000. That is because we are now trading in a currency other than pure money which represents a different value to each negotiator.

Let’s go back to our Value Formula and plug in these numbers V = (B – C); in this example:

Let’s go back to our Value Formula and plug in these numbers V = (B – C); in this example:

V = (16,000 – 12,000) = £4,000.

Finding these Alternative Currencies requires a bit of thought and flexibility. Organisationally, companies tend to be exceptionally good at measuring Cost but they are less good at quantifying and measuring Benefit, especially when a Benefit is presented in some intangible form. But, precisely because Benefit is sometimes hard to capture, it represents a great opportunity for negotiators to trade creatively.

If you are thinking about your next negotiation with the ambition of creating Value for you and your negotiation partner you now know that Money is not Valuable. So, what is?

That will vary from business to business but it would be worthwhile thinking about what might represent Value to you and to the other party. The following are just a few suggestions:

The list is endless but a few minutes thought or brainstorming with colleagues will almost certainly lead you to value-generating variables that you had not previously considered. Money is not the root of all evil, but a preoccupation with all things monetary can be a hindrance to Value Creation – and remember that money is not valuable in itself.

This article has been written with the help of Alistair White, partner at The Gap Partnership.

Leave A Comment