As US stocks continue reaching new – and newer – heights, margin debt continues to grow by leaps and bounds. Equity bulls are riding the debt wave, even as bears point to the suffering it will cause eventually.

FINRA (Financial Industry Regulatory Authority) margin debt rose $5.9 billion month-over-month in July to $652.8 billion, not too far away from the all-time high of $668.9 billion which was recorded in May. In January when US stocks toward the end of the month retreated for a quick double-digit decline into early February, margin debt reached $665.7 billion. These are massive numbers.

To get an idea about how it has grown over time, let us consider that in February 2016 margin debt was $474.2 billion. US stocks reached a major bottom back then. The S&P 500 large cap index bottomed at an intraday low of 1810.10 (arrow in Chart 1). This August, the index rose three percent m/m to 2901.52. Several other indices did much better last month, with the Nasdaq composite up 5.7 percent and the Russell 2000 small cap index up 4.2 percent. In all likelihood, margin debt continued to rise in August, if not made a new high.

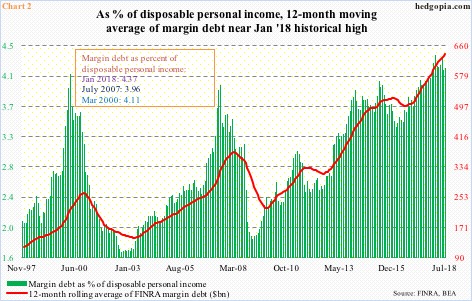

Chart 2 uses a personal income measure to highlight how elevated margin debt currently is. The green bars represent margin debt as a percent of disposable personal income. The latter in July was $15.6 trillion, up 42.3 percent from June 2009, when Great Recession ended. Margin debt during the period surged 200.1 percent. Thus the persistently rising bars.

During the dot-com bubble, margin debt as a percent of disposable personal income peaked at 4.1 percent in March 2000. Then during the housing bubble/financial crisis, it peaked at four percent in July 2007. This January, both those prior peaks were surpassed, as the green bar rose to 4.4 percent. July was 4.2 percent.

This is way elevated – historically, of course – and this is what equity bears are focused on. Their argument that the buildup in margin debt is not sustainable is unassailable. When these things reverse, this will leave behind a lot of pain, as evident in how margin debt shrank once the prior two bubbles ended. But at the same time, what is to say it cannot continue higher?

Leave A Comment