In Gold we Trust Report: Bull Market Will Continue

The 11th edition of the annual “In Gold we Trust” is another must read synopsis of the fundamentals of the gold market, replete with excellent charts by our friend Ronald-Peter Stoeferle and his colleague Mark Valek of Incrementum AG.

Key topics and takeaways of the report:

– “Sell economic ignorance, buy gold …”

– Many signals suggest that we are about to face a big shift within the financial and monetary system

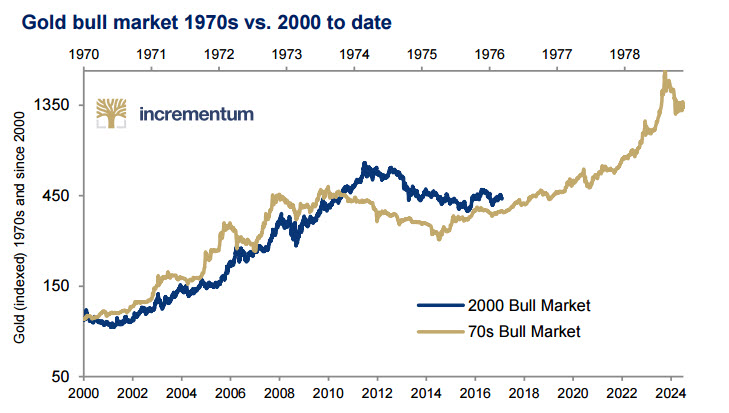

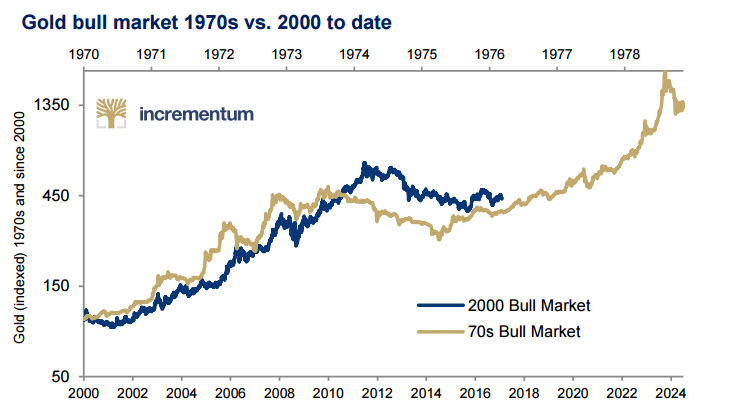

– 5 reasons why the gold bull market will continue

– Gold’s gains in 2016 dampened due to high expectations of Trump’s growth policy

– Gold still up 8.5% in 2016 and 10.2% since January 2017

– Attempt at normalization of U.S. monetary policy will be litmus test for US economy

– Bitcoin: Digital gold or fool’s gold?

– White, Gray and Black Swans and consequences for gold price

– Exclusive Interview with Dr. Judy Shelton (Economic advisor to Donald Trump) about a possible remonetisation of gold

– Prudent investors should consider accumulating gold and gold stocks now due to excessive global debt, the “gradual reduction of the U.S. dollar’s importance as a global reserve currency” and the high probability that the U.S. is close to entering a recession

– “It is a case of better having insurance and not needing it, than one day realizing that one needs it but doesn’t have it…”

– “We live in an age of advanced monetary surrealism….”

Research can be downloaded here:

In Gold we Trust – Extended version (169 pages)

In Gold we Trust – Compact version (29 pages)

Leave A Comment